US Airways 2004 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2004 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

AMERICA WEST HOLDINGS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

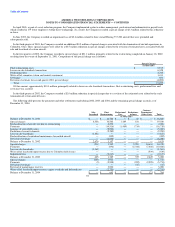

10. Employee Benefit Plan

The Company has a 401(k) defined contribution plan, covering essentially all employees of the Company. Participants may contribute from 1 to 50% of

their pretax earnings to a maximum of $13,000 in 2004. The Company's matching contribution is determined annually by the Board of Directors. The

Company's contribution expense to the plan totaled $11.4 million, $8.7 million and $8.7 million in 2004, 2003 and 2002, respectively.

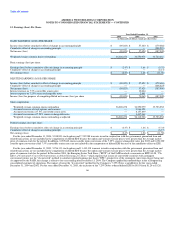

During the third quarter of 2004, the Company became aware that an insufficient number of shares of its Class B common stock were registered for offer

and sale through its 401(k) plan. In response to this registration shortfall, the Company promptly filed a new registration statement on Form S-8 on August 13,

2004, which registered an additional 4,500,000 shares of Class B common stock to permit the continued offer and sale of such shares to participants through

the 401(k) plan. Because the 401(k) plan in the past has purchased and in the future expects to continue to purchase shares of Class B common stock needed

for allocation to participant accounts only in the open market and not directly from the Company, the registration of these additional shares and their purchase

by the 401(k) plan will have no dilutive impact on the outstanding equity of the Company. As a result of the registration shortfall, however, participants who

acquired unregistered shares through their 401(k) plan accounts after June 30, 2003, and prior to August 13, 2004, may be entitled to rescission rights or other

remedies under the Securities Act of 1933, as amended. The Company has notified affected existing and former plan participants of their potential rescission

rights, but cannot predict the extent to which any such rescission rights may be exercised or the impact of any possible federal or state regulatory action

pertaining to the registration shortfall. The Company does not believe, however, that any consequences arising from the registration shortfall will have a

material adverse effect on its financial position or results of operations.

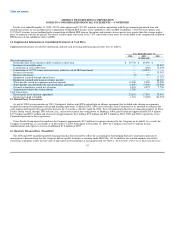

11. Special Charges

In the first quarter of 2004, the Company recorded a $0.6 million reduction in special charges related to the revision of estimated costs associated with the

sale and leaseback of certain aircraft.

In August 2004, the Company entered into definitive agreements with two lessors to return six Boeing 737-200 aircraft. Three of these aircraft were

returned to the lessors in the third quarter, two were returned in the fourth quarter and one was returned in January 2005. In addition, the Company continues

negotiating with one lessor on the return of its remaining two Boeing 737-200 aircraft, one of which was parked in March 2002. The other aircraft was

removed from service in January 2005. In connection with the return of the aircraft, the Company recorded $1.9 million of special charges which include lease

termination payment of $2.1 million, the write-down of leasehold improvements and aircraft rent balance of $2.8 million, offset by the net reversal of

maintenance reserves of $3.0 million.

In December 2004, the Company and General Electric ("GE") mutually agreed to terminate the V2500 A-1 power by hour (PBH) agreement effective

January 1, 2005. This agreement was entered into March 1998 with an original term of ten years. For terminating the agreement early, the Company received

a $20.0 million credit to be applied to amounts due for other engines under the 1998 agreement that is expected to be fully applied by December 31, 2005. The

Company had capitalized PBH payments for V2500 A-1 engines in excess of the unamortized cost of the overhauls performed by GE of approximately

$3.7 million. With the termination of this agreement, these payments were not realizable and as a result, the Company wrote off this amount against the

$20.0 million credit referred to above resulting in a $16.3 million net gain.

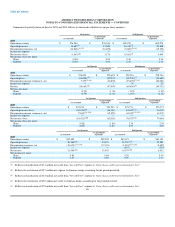

In February 2003, AWA announced the elimination of its hub operations in Columbus, Ohio. As a result, 12 regional jets, all of which were operated by

Chautauqua Airlines under the America West Express banner, have been phased out of the fleet. In addition, the hub has been downsized from 49 daily

departures to 15 destinations to four flights per day to Phoenix and Las Vegas. Service to New York City La Guardia Airport was also eliminated because

perimeter rules at the airport prohibit flights beyond 1,500 miles, precluding service from AWA's hubs in Phoenix and Las Vegas. In the first and second

quarters of 2003, the Company recorded special charges of $1.0 million and $9.6 million, respectively, related to the costs associated with the termination of

certain aircraft and facility contracts, employee transfer and severance expenses and the write-off of leasehold improvements in Columbus, Ohio.

In the first quarter of 2003, the Company recorded a $1.1 million reduction in special charges related to the earlier-than-planned return of certain leased

aircraft in 2001 and 2002, as all payments related to these aircraft returns have been made.

63