US Airways 2004 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2004 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

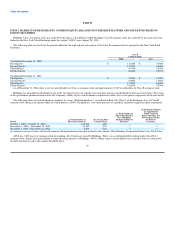

We have implemented a fuel-hedging program to manage the risk and effect of fluctuating jet fuel prices on our business. Our hedging program is intended

to offset increases in jet fuel costs by using derivative instruments keyed to the future price of heating oil, which is highly correlated to the price of jet fuel

delivered on the East Coast of the United States. Our hedging program does not fully protect us against increasing jet fuel costs because our hedging program

does not cover all of our projected jet fuel volumes for 2005. Hedging transactions are in place with respect to approximately 45% and 2% of remaining

projected 2005 and 2006 jet fuel requirements, respectively. Furthermore, our ability to effectively hedge jet fuel prices is limited because we purchase a

substantially larger portion of our jet fuel requirements on the West Coast of the United States compared to our large competitors and West Coast fuel prices

are less correlated to heating oil prices and other viable petroleum derivatives than East Coast fuel prices and, therefore, more difficult to hedge. The

effectiveness of our fuel-hedging program may also be negatively impacted by continued instability in oil producing regions such as the Middle East, Nigeria,

Russia and Venezuela.

Because of our relatively low credit ratings, our borrowing costs may be high and our ability to incur additional debt may be impaired.

Our credit ratings are relatively low, with Moody's assessment of AWA's senior implied rating and senior unsecured debt rating at B3 and Caa2,

respectively, Standard & Poor's assessment of AWA's and Holdings' corporate credit ratings at B- and AWA's senior unsecured rating at CCC, and Fitch

Ratings' assessment of AWA's long-term and senior unsecured debt rating at CCC. In addition, Standard & Poor's recently placed AWA's aircraft debt on

CreditWatch with negative implications as part of a broader review of aircraft-backed debt. Low credit ratings could cause our future borrowing costs to

increase, which would increase our interest expense and could affect our earnings and our credit ratings could adversely affect our ability to obtain additional

financing. The rating agencies base their ratings on our financial performance and operations, our cash flow and liquidity, the level of our indebtedness and

industry conditions in general. If our financial performance or industry conditions do not improve, we may face future downgrades, which could further

negatively impact our borrowing costs and the prices of our equity or debt securities. In addition, any downgrade of our credit ratings may indicate a decline

in our business and in our ability to satisfy our obligations under our indebtedness.

Negotiations with labor unions could divert management attention and disrupt operations and new collective bargaining agreements or amendments to

existing collective bargaining agreements could increase our labor costs and operating expenses.

Some of our employees are represented by unions and other groups of our employees may seek union representation in the future. Negotiations with the

IBT for a second collective bargaining agreement covering the Airline's mechanics and related employees commenced on October 9, 2003 and are ongoing.

Additionally, negotiations with the AFA on a second contract covering the Company's flight attendants commenced on February 4, 2004 and are ongoing. On

August 18, 2004, the National Mediation Board certified the IBT as the collective bargaining representative for the Company's passenger service employees

and reservations agents. Negotiations are expected to begin April 2005.

We cannot predict the outcome of the negotiations with the IBT or AFA or any future negotiations relating to union representation or collective bargaining

agreements. Agreements reached in collective bargaining may increase operating expenses and lower operating results and net income. This is particularly

significant because our current employee costs contribute substantially to the low cost structure that we believe is one of our competitive strengths and

because we are required to repay a portion of the government guaranteed loan if our labor costs exceed a certain threshold. In addition, negotiations with

unions could divert management attention and disrupt operations, which may result in increased operating expenses and lower net income. If we are unable to

negotiate acceptable collective bargaining agreements, we might have to address the threat of, or wait through, "cooling off" periods, which could be followed

by union-initiated work actions, including strikes. Depending on the nature of the threat or the type and duration of any work action, these actions could

disrupt our operations and, as a result, have a significant adverse affect on our operating results.

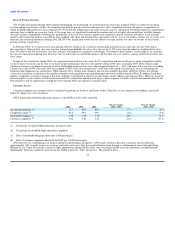

Fluctuations in interest rates could adversely affect our liquidity, operating expenses and results.

A substantial portion of our indebtedness bears interest at fluctuating interest rates based on the London interbank offered rate for deposits of U.S. dollars,

or LIBOR. LIBOR tends to fluctuate based on general economic conditions, general interest rates, including the prime rate, and the supply of and demand for

credit in the London interbank market. We have not hedged our interest rate exposure and, accordingly, our interest expense for any particular period may

fluctuate based on LIBOR. To the extent LIBOR increases, our interest expense will increase, in which event, we may have difficulties making interest

payments and funding our other fixed costs and our

14