US Airways 2004 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2004 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

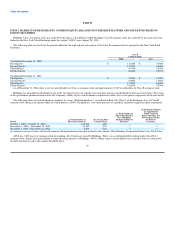

• Other operating expenses per ASM decreased 2.6% to $1.41 from $1.44 primarily due to decreases in catering costs ($6.3 million), bad debt expense

($2.6 million) and traffic liability insurance ($1.8 million). These decreases were partially offset by increases in aircraft jet fuel tax ($4.7 million),

passenger traffic related expenses ($4.2 million), reservation system booking fees ($4.1 million), legal fees ($3.6 million), computer credit card

discount fees ($3.5 million), airport guard services ($1.9 million) and ground handling expenses ($1.6 million). As a result, other operating expenses

increased by $21.4 million. In addition, the 2004 period also included a $5.1 million charge resulting from the settlement of the shareholder lawsuit,

a $4.6 million charge related to the sale and leaseback transactions of two new aircraft, a $3.5 million gain resulting from the settlement of a claim in

bankruptcy for amounts earned under an executory contract, a $2.0 million gain resulting from the settlement of a lawsuit related to certain computer

hardware and software that had previously been written off, a $1.0 million charge related to an arbitration settlement with Aeroxchange and a

$1.0 million volume incentive earned due to certain Affinity Card sales levels meeting certain contract thresholds. The comparable 2003 period

includes a $4.4 million gain related to the purchase and subsequent exchange of an A320 airframe.

AWA had net nonoperating expense of $45.5 million in 2004 compared to net nonoperating income of $35.3 million in 2003. The 2003 period benefited

from $81.3 million of federal government assistance received under the Emergency Wartime Supplemental Appropriations Act. See Note 16, "Emergency

Wartime Supplemental Appropriations Act" in AWA's Notes to Consolidated Financial Statements. In 2004, debt issue costs totaling $1.3 million were written

off in connection with the refinancing of the term loan. This was more than offset by a gain on the disposition of property and equipment ($1.1 million)

primarily due to the sale of two Boeing 737-200 aircraft. Interest income increased $0.9 million or 6.9% due to higher average cash balances in the 2004

period. The changes in the fair value of the Company's derivative instruments and the net realized gains for the settled hedge transactions was a $23.8 million

credit in 2004 compared to a $10.7 million credit in the 2003 period. Interest expense remained flat year-over-year. The 2003 period also includes a

$9.8 million gain related to the sale of an investment in Hotwire.com. See Note 12, "Nonoperating Income (Expenses) – Other, Net" in AWA's Notes to

Consolidated Financial Statements.

2003 Compared with 2002

AWA recorded operating income of $26.1 million in 2003 compared to an operating loss of $156.2 million in 2002. Income before income taxes was

$61.4 million in 2003 compared to a loss before income taxes and the cumulative effect of a change in accounting principle of $212.0 million in 2002.

Total operating revenues for 2003 were $2.3 billion. Passenger revenues were $2.1 billion in 2003 compared to $1.9 billion in 2002. A 7.1% increase in

RPMs exceeded a 3.3% increase in capacity, as measured by ASMs, resulting in a 2.8 point increase in load factor to 76.4%. RASM during 2003 increased

6.2 percent to 7.58 cents, despite a 5.9 percent increase in average stage length, while yields improved 2.3 percent to 9.93 cents. Cargo revenues for 2003

decreased $0.7 million (2.4%) due to lower freight and mail volumes. Other revenues, which consist primarily of alcoholic beverage sales, contract service

sales, service charges, America West Vacations net revenues and Mesa codeshare agreement revenues, increased $23.7 million (26.5%) due to increased net

revenues from AWA's code sharing agreement with Mesa Airlines, higher excess baggage revenue and higher ticket refund and reissue penalty fees for

ticketing changes.

Operating expenses, including special charges of $14.4 million and $19.0 million recognized in 2003 and 2002, respectively, (see Note 11, "Special

Charges" in AWA's Notes to Consolidated Financial Statements) increased $24.9 million or 1.1%, while ASMs increased 3.3% in 2003 as compared to 2002.

As a result, CASM decreased 2.1% to 7.99 cents in 2003 from 8.16 cents in 2002. Significant changes in the components of operating expense per ASM are

explained as follows:

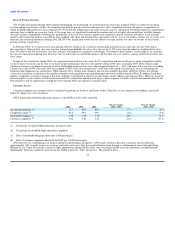

• Salaries and related costs per ASM increased 5.9% primarily due to an increase in the accrual for employee performance bonuses and AWArd Pay

($20.1 million), charges related to the execution of a new labor agreement between AWA and ALPA ($19.7 million), higher medical, disability and

workers' compensation insurance costs ($6.7 million), vacation expense due to a change in the Company's vacation policy for certain administrative

employees in 2002 ($6.4 million) and DOT on-time performance bonuses ($2.3 million). These increases were offset in part by a 4.5% decrease

FTEs in 2003 as compared to 2002, driven by the Company's decision to eliminate its Columbus hub operations and the reduction-in-force of

management, administrative and professional employees.

• Aircraft rent expense per ASM decreased 2.3% due to a reduction of rental rates as a result of lease extensions that occurred in 2003.

29