Tyson Foods 2013 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2013 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

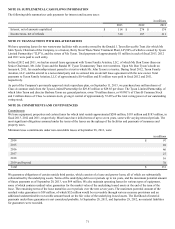

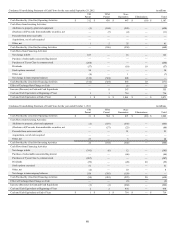

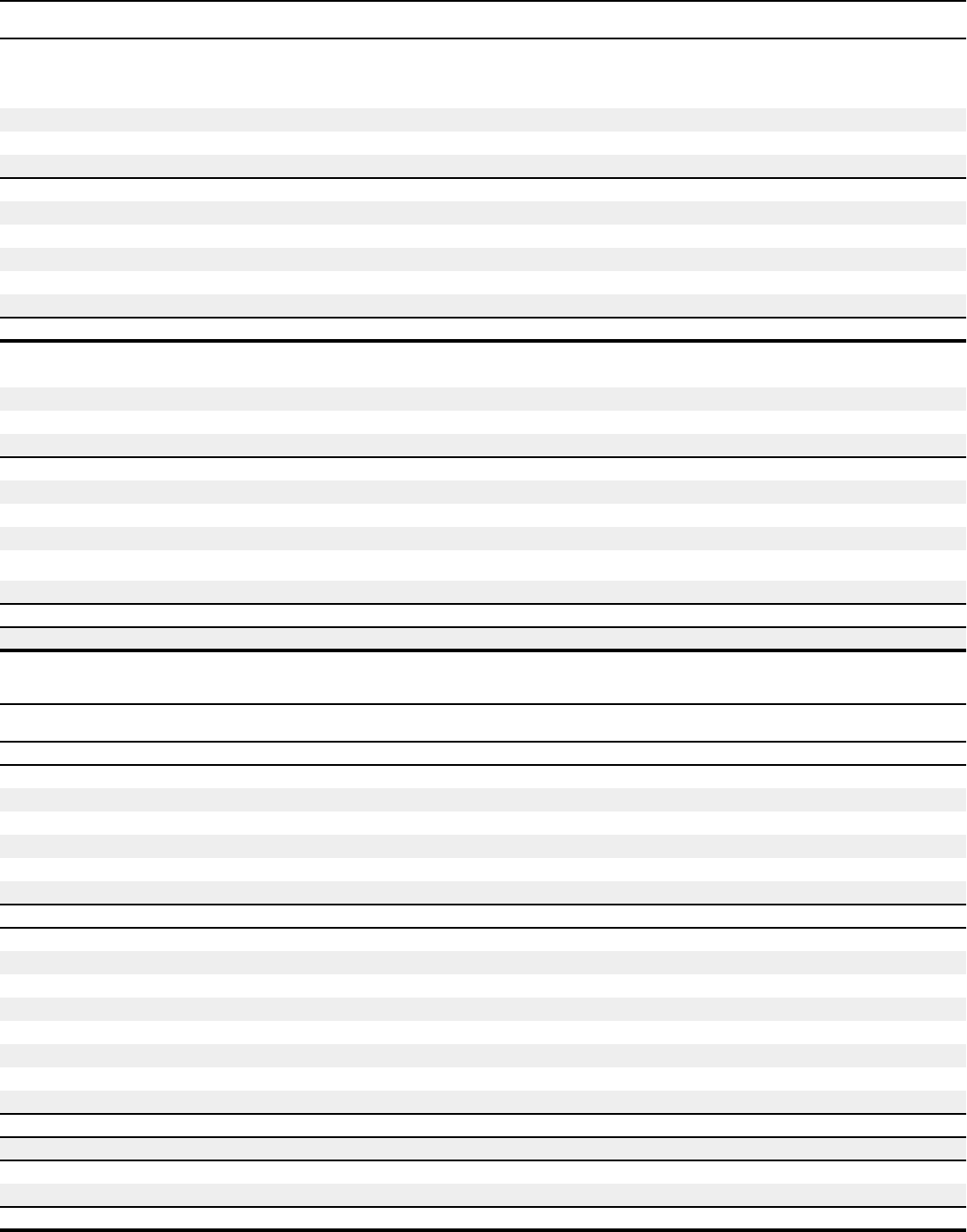

Condensed Consolidating Balance Sheet as of September 29, 2012 in millions

TFI

Parent TFM

Parent Non-

Guarantors Eliminations Total

Assets

Current Assets:

Cash and cash equivalents $ 1 $ 9 $ 1,061 $ — $ 1,071

Accounts receivable, net 1 499 878 — 1,378

Inventories — 950 1,859 — 2,809

Other current assets 139 100 90 (184) 145

Total Current Assets 141 1,558 3,888 (184) 5,403

Net Property, Plant and Equipment 31 873 3,118 — 4,022

Goodwill — 881 1,010 — 1,891

Intangible Assets — 26 103 — 129

Other Assets 1,257 151 251 (1,208) 451

Investment in Subsidiaries 11,849 2,005 — (13,854) —

Total Assets $ 13,278 $ 5,494 $ 8,370 $ (15,246) $ 11,896

Liabilities and Shareholders’ Equity

Current Liabilities:

Current debt $ 439 $ — $ 167 $ (91) $ 515

Accounts payable 10 558 804 — 1,372

Other current liabilities 4,887 144 766 (4,854) 943

Total Current Liabilities 5,336 702 1,737 (4,945) 2,830

Long-Term Debt 1,774 809 486 (1,152) 1,917

Deferred Income Taxes — 135 432 (9) 558

Other Liabilities 156 146 294 (47) 549

Total Tyson Shareholders’ Equity 6,012 3,702 5,391 (9,093) 6,012

Noncontrolling Interests ——30—30

Total Shareholders’ Equity 6,012 3,702 5,421 (9,093) 6,042

Total Liabilities and Shareholders’ Equity $ 13,278 $ 5,494 $ 8,370 $ (15,246) $ 11,896

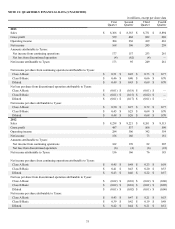

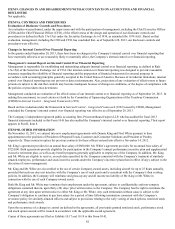

Condensed Consolidating Statement of Cash Flows for the year ended September 28, 2013 in millions

TFI

Parent TFM

Parent Non-

Guarantors Eliminations Total

Cash Provided by (Used for) Operating Activities $ 294 $ 337 $ 696 $ (13) $ 1,314

Cash Flows from Investing Activities:

Additions to property, plant and equipment (4) (113) (441) — (558)

(Purchases of)/Proceeds from marketable securities, net — (13) (5) — (18)

Proceeds from notes receivable —————

Acquisitions, net of cash acquired — — (106) — (106)

Other, net — 3 36 — 39

Cash Provided by (Used for) Investing Activities (4) (123) (516) — (643)

Cash Flows from Financing Activities:

Net change in debt 5 — (28) — (23)

Purchase of redeemable noncontrolling interest —————

Purchases of Tyson Class A common stock (614) — — — (614)

Dividends (104) — (13) 13 (104)

Stock options exercised 123 — — — 123

Other, net 18———18

Net change in intercompany balances 281 (202) (79) — —

Cash Provided by (Used for) Financing Activities (291) (202) (120) 13 (600)

Effect of Exchange Rate Change on Cash — — 3 — 3

Increase (Decrease) in Cash and Cash Equivalents (1) 12 63 — 74

Cash and Cash Equivalents at Beginning of Year 1 9 1,061 — 1,071

Cash and Cash Equivalents at End of Year $ — $ 21 $ 1,124 $ — $ 1,145