Tyson Foods 2013 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2013 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76

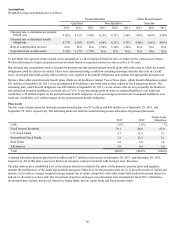

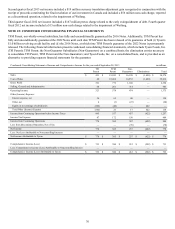

Second quarter fiscal 2013 net income included a $19 million currency translation adjustment gain recognized in conjunction with the

receipt of proceeds constituting the final resolution of our investment in Canada and included a $56 million non-cash charge, reported

as a discontinued operation, related to the impairment of Weifang.

Third quarter fiscal 2012 net income included a $167 million pretax charge related to the early extinguishment of debt. Fourth quarter

fiscal 2012 net income included a $15 million non-cash charge related to the impairment of Weifang.

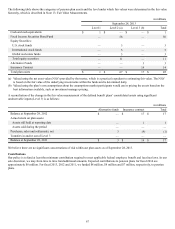

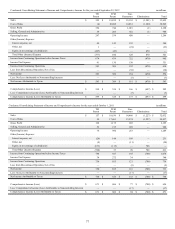

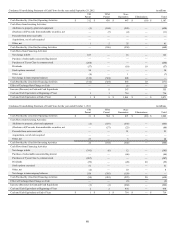

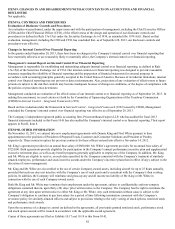

NOTE 22: CONDENSED CONSOLIDATING FINANCIAL STATEMENTS

TFM Parent, our wholly-owned subsidiary, has fully and unconditionally guaranteed the 2016 Notes. Additionally, TFM Parent has

fully and unconditionally guaranteed the 2022 Notes until such date TFM Parent has been released of its guarantee of both (i) Tyson's

$1.0 billion revolving credit facility and (ii) the 2016 Notes, at which time TFM Parent's guarantee of the 2022 Notes is permanently

released. The following financial information presents condensed consolidating financial statements, which include Tyson Foods, Inc.

(TFI Parent); TFM Parent; the Non-Guarantor Subsidiaries (Non-Guarantors) on a combined basis; the elimination entries necessary

to consolidate TFI Parent, TFM Parent and the Non-Guarantors; and Tyson Foods, Inc. on a consolidated basis, and is provided as an

alternative to providing separate financial statements for the guarantor.

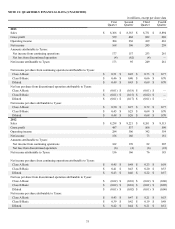

Condensed Consolidating Statement of Income and Comprehensive Income for the year ended September 28, 2013 in millions

TFI

Parent TFM

Parent Non-

Guarantors Eliminations Total

Sales $ 431 $ 19,243 $ 16,120 $ (1,420) $ 34,374

Cost of Sales 40 18,464 14,932 (1,420) 32,016

Gross Profit 391 779 1,188 — 2,358

Selling, General and Administrative 68 201 714 — 983

Operating Income 323 578 474 — 1,375

Other (Income) Expense:

Interest expense, net 36 62 40 — 138

Other, net 4 (1) (23) — (20)

Equity in net earnings of subsidiaries (582) (40) — 622 —

Total Other (Income) Expense (542) 21 17 622 118

Income from Continuing Operations before Income Taxes 865 557 457 (622) 1,257

Income Tax Expense 87 172 150 — 409

Income from Continuing Operations 778 385 307 (622) 848

Loss from Discontinued Operation, Net of Tax — — (70) — (70)

Net Income 778 385 237 (622) 778

Less: Net Loss Attributable to Noncontrolling Interests —————

Net Income Attributable to Tyson $ 778 $ 385 $ 237 $ (622) $ 778

Comprehensive Income (Loss) $ 733 $ 380 $ 212 $ (592) $ 733

Less: Comprehensive Income (Loss) Attributable to Noncontrolling Interest —————

Comprehensive Income (Loss) Attributable to Tyson $ 733 $ 380 $ 212 $ (592) $ 733