Tyson Foods 2013 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2013 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

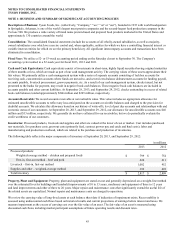

Description Judgments and Uncertainties Effect if Actual Results Differ From

Assumptions

Impairment of long-lived assets

Long-lived assets are evaluated for

impairment whenever events or changes

in circumstances indicate the carrying

value may not be recoverable. Examples

include a significant adverse change in the

extent or manner in which we use a long-

lived asset or a change in its physical

condition.

When evaluating long-lived assets for

impairment, we compare the carrying

value of the asset to the asset’s estimated

undiscounted future cash flows. An

impairment is indicated if the estimated

future cash flows are less than the

carrying value of the asset. The

impairment is the excess of the carrying

value over the fair value of the long-lived

asset.

We recorded impairment charges related

to long-lived assets of $74 million, $29

million and $18 million, in fiscal 2013,

2012 and 2011, respectively.

Our impairment analysis contains

uncertainties due to judgment in

assumptions and estimates surrounding

undiscounted future cash flows of the

long-lived asset, including forecasting

useful lives of assets and selecting the

discount rate that reflects the risk inherent

in future cash flows to determine fair

value.

Our Dynamic Fuels consolidated joint

venture began commercial operations in

October of 2010 and has incurred net

operating losses of approximately $38

million since then. At September 28,

2013, Dynamic Fuels had $166 million of

total assets, of which $142 million was net

property, plant and equipment. The plant

has experienced mechanical difficulties,

pre-treatment system performance issues

and hydrogen supply disruptions, which

have contributed to plant down time and

higher than expected operational costs.

Upgrades to the feedstock pre-treatment

systems and improvements to the

mechanical reliability of the plant were

completed in fiscal 2013.

The plant was idled in October 2012 for

scheduled maintenance and plant

upgrades, which were completed in

December 2012. Since then, the plant has

remained idled. An assessment of the

recoverability of its carrying value was

conducted as of September 28, 2013, for

which it was determined no impairment

was necessary. Another assessment of the

recoverability of Dynamic Fuels' long-

lived assets to determine whether an

impairment exists may be necessary if the

plant remains idled longer than expected,

plant upgrades fail to improve operational

performance, industry economics make

the plant uneconomical to operate, or

structural integrity concerns are

discovered that adversely impact the plant

operations.

We have not made any material changes

in the accounting methodology used to

evaluate the impairment of long-lived

assets during the last three fiscal years.

We do not believe there is a reasonable

likelihood there will be a material change

in the estimates or assumptions used to

calculate impairments of long-lived assets.

However, if actual results are not

consistent with our estimates and

assumptions used to calculate estimated

future cash flows, we may be exposed to

impairment losses that could be material.

Additionally, we continue to evaluate our

international operations and strategies,

which may expose us to future

impairment losses.

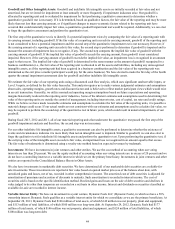

Impairment of goodwill and other indefinite life intangible assets

Description: Goodwill is evaluated for impairment by first performing a qualitative assessment to determine whether a quantitative

goodwill test is necessary. If it is determined, based on qualitative factors, the fair value of the reporting unit may be more likely than

not less than carrying amount or if significant changes to macro-economic factors related to the reporting unit have occurred that could

materially impact fair value, a quantitative goodwill impairment test would be required. We can elect to forgo the qualitative

assessment and perform the quantitative test.

The quantitative goodwill impairment test is performed using a two-step process. The first step is to identify if a potential impairment

exists by comparing the fair value of a reporting unit with its carrying amount, including goodwill. If the fair value of a reporting unit

exceeds its carrying amount, goodwill of the reporting unit is not considered to have a potential impairment and the second step of the

quantitative impairment test is not necessary. However, if the carrying amount of a reporting unit exceeds its fair value, the second

step is performed to determine if goodwill is impaired and to measure the amount of impairment loss to recognize, if any.

The second step compares the implied fair value of goodwill with the carrying amount of goodwill. If the implied fair value of

goodwill exceeds the carrying amount, then goodwill is not considered impaired. However, if the carrying amount of goodwill exceeds

the implied fair value, an impairment loss is recognized in an amount equal to that excess.