Tyson Foods 2013 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2013 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

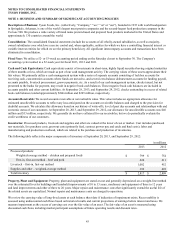

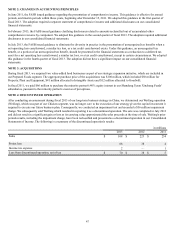

NOTE 2: CHANGES IN ACCOUNTING PRINCIPLES

In June 2011, the FASB issued guidance regarding the presentation of comprehensive income. This guidance is effective for annual

periods, and interim periods within those years, beginning after December 15, 2011. We adopted this guidance in the first quarter of

fiscal 2013. The adoption required a separate statement of comprehensive income and additional disclosures on our consolidated

financial statements.

In February 2013, the FASB issued guidance clarifying disclosures related to amounts reclassified out of accumulated other

comprehensive income by component. We adopted this guidance in the second quarter of fiscal 2013. The adoption required additional

disclosures in our consolidated financial statements.

In July 2013, the FASB issued guidance to eliminate the diversity in practice in the presentation of unrecognized tax benefits when a

net operating loss carryforward, a similar tax loss, or a tax credit carryforward exists. Under this guidance, an unrecognized tax

benefit, or a portion of an unrecognized tax benefit, should be presented in the financial statements as a reduction to a deferred tax

asset for a net operating loss carryforward, a similar tax loss, or a tax credit carryforward, except in certain circumstances. We adopted

this guidance in the fourth quarter of fiscal 2013. The adoption did not have a significant impact on our consolidated financial

statements.

NOTE 3: ACQUISITIONS

During fiscal 2013, we acquired two value-added food businesses as part of our strategic expansion initiative, which are included in

our Prepared Foods segment. The aggregate purchase price of the acquisitions was $106 million, which included $50 million for

Property, Plant and Equipment, $41 million allocated to Intangible Assets and $12 million allocated to Goodwill.

In fiscal 2011, we paid $66 million to purchase the minority partner's 40% equity interest in our Shandong Tyson Xinchang Foods'

subsidiaries, pursuant to the minority partner's exercise of put options.

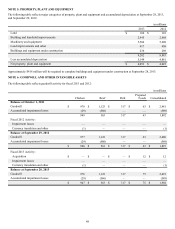

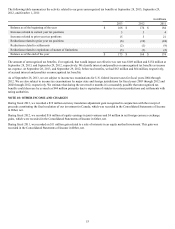

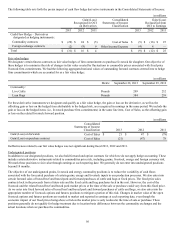

NOTE 4: DISCONTINUED OPERATION

After conducting an assessment during fiscal 2013 of our long-term business strategy in China, we determined our Weifang operation

(Weifang), which was part of our Chicken segment, was no longer core to the execution of our strategy given the capital investment it

required to execute our future business plan. Consequently, we conducted an impairment test and recorded a $56 million impairment

charge. We subsequently sold Weifang which resulted in reporting it as a discontinued operation. The sale was completed in July 2013

and did not result in a significant gain or loss as its carrying value approximated the sales proceeds at the time of sale. Weifang's prior

periods results, including the impairment charge, have been reclassified and presented as a discontinued operation in our Consolidated

Statements of Income. The following is a summary of the discontinued operation's results:

in millions

2013 2012 2011

Sales $ 108 $ 223 $ 234

Pretax loss 68 38 4

Income tax expense 2 — 1

Loss from discontinued operation, net of tax $ 70 $ 38 $ 5