Tyson Foods 2013 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2013 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

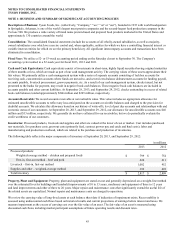

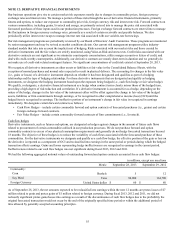

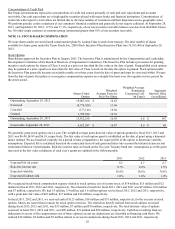

The following table summarizes the activity related to our gross unrecognized tax benefits at September 28, 2013, September 29,

2012, and October 1, 2011:

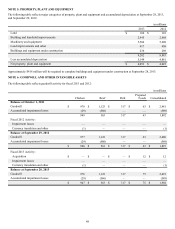

in millions

2013 2012 2011

Balance as of the beginning of the year $ 168 $ 174 $ 184

Increases related to current year tax positions 334

Increases related to prior year tax positions 15 5 21

Reductions related to prior year tax positions (6)(10) (24)

Reductions related to settlements (2)(1) (9)

Reductions related to expirations of statute of limitations (3)(3) (2)

Balance as of the end of the year $ 175 $ 168 $ 174

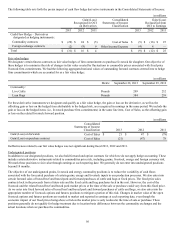

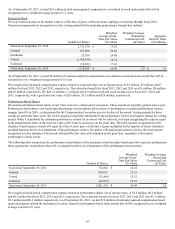

The amount of unrecognized tax benefits, if recognized, that would impact our effective tax rate was $149 million and $154 million at

September 28, 2013, and September 29, 2012, respectively. We classify interest and penalties on unrecognized tax benefits as income

tax expense. At September 28, 2013, and September 29, 2012, before tax benefits, we had $63 million and $64 million, respectively,

of accrued interest and penalties on unrecognized tax benefits.

As of September 28, 2013, we are subject to income tax examinations for U.S. federal income taxes for fiscal years 2004 through

2012. We are also subject to income tax examinations by major state and foreign jurisdictions for fiscal years 2003 through 2012 and

2002 through 2012, respectively. We estimate that during the next twelve months it is reasonably possible that unrecognized tax

benefits could decrease by as much as $44 million primarily due to expiration of statutes in various jurisdictions and settlements with

taxing authorities.

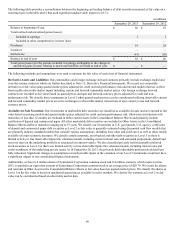

NOTE 10: OTHER INCOME AND CHARGES

During fiscal 2013, we recorded a $19 million currency translation adjustment gain recognized in conjunction with the receipt of

proceeds constituting the final resolution of our investment in Canada, which was recorded in the Consolidated Statements of Income

in Other, net.

During fiscal 2012, we recorded $16 million of equity earnings in joint ventures and $4 million in net foreign currency exchange

gains, which were recorded in the Consolidated Statements of Income in Other, net.

During fiscal 2011, we recorded an $11 million gain related to a sale of interests in an equity method investment. This gain was

recorded in the Consolidated Statements of Income in Other, net.