Tyson Foods 2013 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2013 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

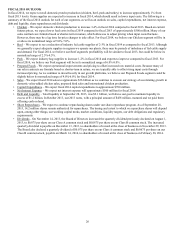

LIQUIDITY AND CAPITAL RESOURCES

Our cash needs for working capital, capital expenditures, growth opportunities, the repurchases of senior notes and share

repurchases are expected to be met with current cash on hand, cash flows provided by operating activities, or short-term

borrowings. Based on our current expectations, we believe our liquidity and capital resources will be sufficient to operate our

business. However, we may take advantage of opportunities to generate additional liquidity or refinance existing debt through

capital market transactions. The amount, nature and timing of any capital market transactions will depend on our operating

performance and other circumstances; our then-current commitments and obligations; the amount, nature and timing of our capital

requirements; any limitations imposed by our current credit arrangements; and overall market conditions.

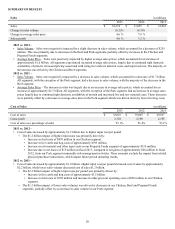

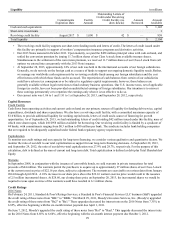

Cash Flows from Operating Activities in millions

2013 2012 2011

Net income $ 778 $ 576 $ 733

Non-cash items in net income:

Depreciation and amortization 519 499 506

Deferred income taxes (12) 140 86

Loss on early extinguishment of debt — 167 —

Impairment of assets 74 34 18

Other, net 26 18 49

Net changes in working capital (71)(247) (346)

Net cash provided by operating activities $ 1,314 $ 1,187 $ 1,046

• Cash flows associated with Loss on early extinguishment of debt included the amount paid exceeding the par value of debt,

unamortized discount and unamortized debt issuance costs related to the full extinguishment of the 2014 Notes.

• Cash flows associated with changes in working capital:

• 2013 – Decreased primarily due to a higher accounts receivable balance, partially offset by increases in accrued salaries,

wages and benefits and income tax payable. The higher accounts receivable balance is largely due to significant

increases in input costs and price increases associated with the increased input costs.

• 2012 – Decreased due to the increase in inventory and accounts receivable balances, partially offset by the increase in

accounts payable. The higher inventory and accounts receivable balances were driven by significant increases in input

costs and price increases associated with the increased input costs.

• 2011 – Decreased due to the increase in inventory and accounts receivable balances, partially offset by the increase in

accounts payable. The higher inventory and accounts receivable balances were driven by significant increases in input

costs and price increases associated with the increased input costs.

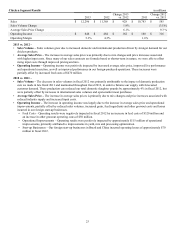

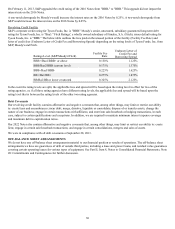

Cash Flows from Investing Activities in millions

2013 2012 2011

Additions to property, plant and equipment $(558) $ (690) $ (643)

Purchases of marketable securities, net (18)(11) (80)

Proceeds from notes receivable — — 51

Acquisitions, net of cash acquired (106) — —

Other, net 39 41 28

Net cash used for investing activities $(643) $ (660) $ (644)

• Additions to property, plant and equipment include acquiring new equipment and upgrading our facilities to maintain

competitive standing and position us for future opportunities. In fiscal 2013, 2012, and 2011, our capital spending was

primarily for production efficiencies in our operations and for ongoing development of foreign operations.

• Capital spending for fiscal 2014 is expected to approximate $700 million, and will include spending on our operations

for production and labor efficiencies, yield improvements and sales channel flexibility, as well as expansion of our

foreign operations.

• Purchases of marketable securities included funding for our deferred compensation plans.

• Proceeds from notes receivable totaling $51 million in fiscal 2011 related to the collection of notes receivable received in

conjunction with the sale of a business operation in fiscal 2009.

• Acquisitions in fiscal 2013 related to acquiring two value-added food businesses as part of our strategic expansion

initiative which are included in our Prepared Foods segment.