Tyson Foods 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

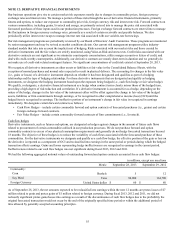

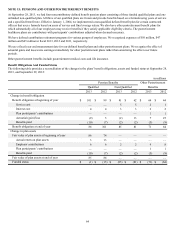

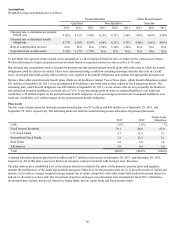

Amounts recognized in the Consolidated Balance Sheets consist of:

in millions

Pension Benefits Other Postretirement

Qualified Non-Qualified Benefits

2013 2012 2013 2012 2013 2012

Accrued benefit liability $(1) $ (15) $ (85) $ (81) $ (71) $ (64)

Accumulated other comprehensive (income)/loss:

Unrecognized actuarial loss 30 39 23 29 — —

Unrecognized prior service (cost)/credit — — — 1 (3) (4)

Net amount recognized $ 29 $ 24 $ (62) $ (51) $ (74) $ (68)

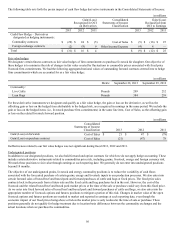

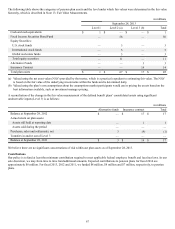

At September 28, 2013, three pension plans had an accumulated benefit obligation in excess of plan assets. At September 29, 2012, all

pension plans had an accumulated benefit obligation in excess of plan assets. Plans with accumulated benefit obligations in excess of

plan assets are as follows:

in millions

Pension Benefits

Qualified Non-Qualified

2013 2012 2013 2012

Projected benefit obligation $ 27 $ 101 $ 85 $ 81

Accumulated benefit obligation 27 101 72 69

Fair value of plan assets 26 86 — —

The accumulated benefit obligation for all qualified pension plans was $86 million and $101 million at September 28, 2013, and

September 29, 2012, respectively.

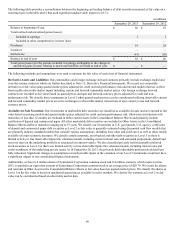

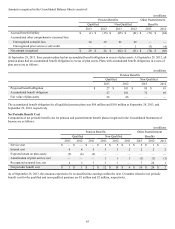

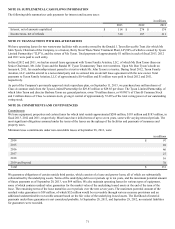

Net Periodic Benefit Cost

Components of net periodic benefit cost for pension and postretirement benefit plans recognized in the Consolidated Statements of

Income are as follows:

in millions

Pension Benefits Other Postretirement

Qualified Non-Qualified Benefits

2013 2012 2011 2013 2012 2011 2013 2012 2011

Service cost $ — $ — $ — $ 5 $ 5 $ 3 $ 2 $ 1 $ —

Interest cost 445332222

Expected return on plan assets (5) (6) (6) — — — — — —

Amortization of prior service cost — — — 1 1 1 (1)(1) (1)

Recognized actuarial loss, net 4 3 3 3 1 — 7 24 1

Net periodic benefit cost $ 3 $ 1 $ 2 $ 12 $ 10 $ 6 $ 10 $ 26 $ 2

As of September 28, 2013, the amounts expected to be reclassified into earnings within the next 12 months related to net periodic

benefit cost for the qualified and non-qualified pensions are $2 million and $2 million, respectively.