Tyson Foods 2013 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2013 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

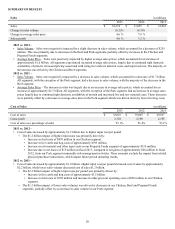

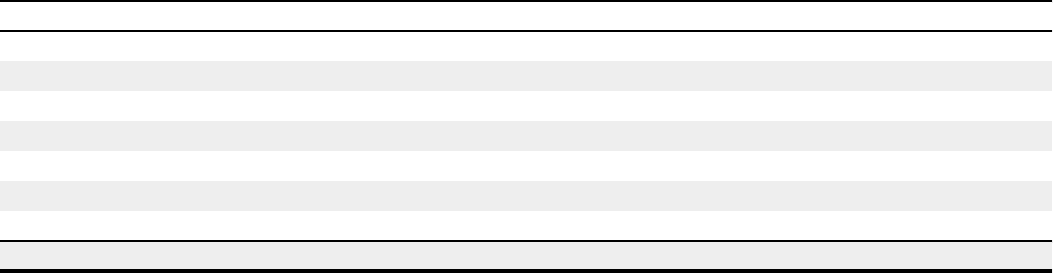

Cash Flows from Financing Activities in millions

2013 2012 2011

Payments on debt $(91) $ (993) $ (500)

Net proceeds from borrowings 68 1,116 115

Purchase of redeemable noncontrolling interest — — (66)

Purchases of Tyson Class A common stock (614)(264) (207)

Dividends (104)(57) (59)

Stock options exercised 123 34 51

Other, net 18 (7) 8

Net cash used for financing activities $(600) $ (171) $ (658)

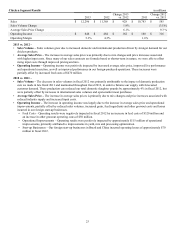

• Payments on debt included –

• 2013 – $91 million primarily related to borrowings at our foreign operations.

• 2012 – $885 million for the extinguishment of the 2014 Notes and $103 million related to borrowings at our foreign

operations.

• 2011 – $315 million of 2011 Notes; $63 million of 2016 Notes; $2 million of 7.0% Notes due May 2018 (2018 Notes);

and $103 million related to borrowings at our foreign operations.

• Net proceeds from borrowings included –

• 2013 – $68 million primarily from our foreign operations. Total debt related to our foreign operations was $60 million

at September 28, 2013 ($40 million current, $20 million long-term).

• 2012 – We received net proceeds of $995 million from the issuance of the 2022 Notes. We used the net proceeds

towards the extinguishment of the 2014 Notes, including the payments of accrued interest and related premiums, and

general corporate purposes. Additionally, our foreign operations received proceeds of $115 million from borrowings.

Total debt related to our foreign operations was $102 million at September 29, 2012 ($62 million current, $40 million

long-term).

• 2011 – Our foreign operations received proceeds of $106 million from borrowings. Total debt related to our foreign

operations was $98 million at October 1, 2011 ($58 million current, $40 million long-term). Additionally, Dynamic

Fuels received $9 million in proceeds from short-term notes in fiscal 2011.

• In fiscal 2011, the minority interest partner in our 60%-owned Shandong Tyson Xinchang Foods joint ventures in China

exercised put options requiring us to purchase its entire 40% equity interest. The transaction closed in fiscal 2011 for cash

consideration totaling $66 million.

• Purchases of Tyson Class A common stock include –

• $550 million, $230 million and $170 million for shares repurchased pursuant to our share repurchase program in

fiscal 2013, 2012 and 2011, respectively; and

• $64 million, $34 million and $37 million for shares repurchased to fund certain obligations under our equity

compensation plans in fiscal 2013, 2012 and 2011, respectively.