Tyson Foods 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

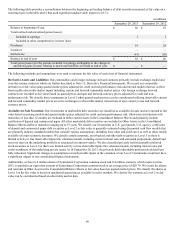

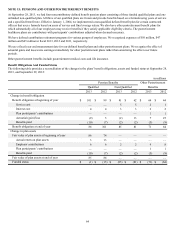

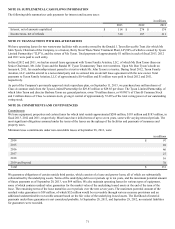

Estimated Future Benefit Payments

The following benefit payments are expected to be paid:

in millions

Pension Benefits Other Postretirement

Qualified Non-Qualified Benefits

2014 $ 6 $ 2 $ 6

2015 7 3 6

2016 5 3 6

2017 5 3 5

2018 6 4 5

2019-2023 27 27 29

The above benefit payments for other postretirement benefit plans are not expected to be offset by Medicare Part D subsidies in 2013

or thereafter.

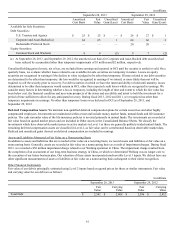

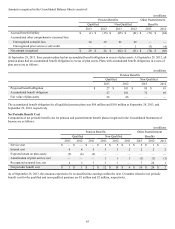

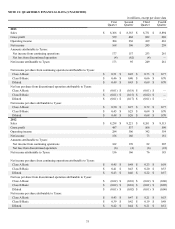

NOTE 16: COMPREHENSIVE INCOME (LOSS)

The components of accumulated other comprehensive loss are as follows:

in millions

2013 2012

Accumulated other comprehensive income (loss), net of taxes:

Unrealized net hedging gain (loss) $ (4) $ 10

Unrealized net gain (loss) on investments (2) 1

Currency translation adjustment (69) (32)

Postretirement benefits reserve adjustments (33) (42)

Total accumulated other comprehensive loss $ (108) $ (63)

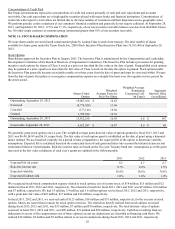

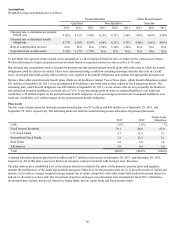

The before and after tax changes in the components of other comprehensive income (loss) are as follows:

in millions

2013 2012 2011

Before

Tax Tax After

Tax Before

Tax Tax After

Tax Before

Tax Tax After

Tax

Derivatives accounted for as cash flow hedges:

(Gain) loss reclassified to Cost of Sales $ 5 $ (2) $ 3 $ 16 $ (7) $ 9 $ (25) $ 10 $ (15)

(Gain) loss reclassified to Other Income/Expense 4 (2) 2 (4) 2 (2) — — —

Unrealized gain (loss) (31) 12 (19) 16 (6) 10 4 (6) (2)

Investments:

Gain reclassified to Other Income/Expense (1) — (1) ——— ———

Unrealized gain (loss) (4) 2 (2) — — — (12) 4 (8)

Currency translation:

Translation gain reclassified to Other Income/

Expense (19)(1)(20) ——— ———

Translation adjustment (20) 3 (17) 2 1 3 (42) 1 (41)

Postretirement benefits (Note 15) 15 (6) 9 (6) 2 (4)(21) 8 (13)

Total Other Comprehensive Income (Loss) $ (51) $ 6 $ (45) $ 24 $ (8) $ 16 $ (96) $ 17 $ (79)