Tyson Foods 2013 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2013 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

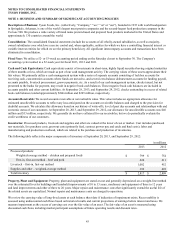

Revolving Credit Facility

We have a $1.0 billion revolving credit facility that supports short-term funding needs and letters of credit. The facility will mature

and the commitments thereunder will terminate in August 2017. After reducing the amount available by outstanding letters of credit

issued under this facility, the amount available for borrowing at September 28, 2013, was $958 million. At September 28, 2013, we

had outstanding letters of credit issued under this facility totaling $42 million, none of which were drawn upon. We had an additional

$146 million of bilateral letters of credit issued separately from the revolving credit facility, none of which were drawn upon. Our

letters of credit are issued primarily in support of workers’ compensation insurance programs, derivative activities and Dynamic Fuels’

Gulf Opportunity Zone tax-exempt bonds.

This facility is unsecured. However, if at any time (the Collateral Trigger Date) we shall fail to have (a) a corporate rating from

Moody's Investors Service, Inc. (Moody's) of "Ba1" or better, (b) a corporate rating from Standard & Poor's Ratings Services, a

Standard & Poor's Financial Services LLC business (S&P), of "BB+" or better, or (c) a corporate rating from Fitch Ratings, a wholly

owned subsidiary of Fimalac, S.A. (Fitch), of "BB+" or better, we, any subsidiary that has guaranteed any material indebtedness of the

Company, and substantially all of our other domestic subsidiaries shall be required to secure the obligations under the credit agreement

and related documents with a first-priority perfected security interest in our and such subsidiary's cash, deposit and securities accounts,

accounts receivable and related assets, inventory and proceeds of any of the foregoing (the Collateral Requirement).

If on any date prior to any Collateral Trigger Date we shall have (a) a corporate rating from Moody's of "Baa2" or better, (b) a

corporate rating from S&P of "BBB" or better and (c) a corporate rating from Fitch of "BBB" or better, in each case with stable or

better outlook, then the Collateral Requirement will no longer be effective.

This facility is fully guaranteed by Tyson Fresh Meats, Inc (TFM Parent), our wholly owned subsidiary, until such date TFM Parent is

released from all of its guarantees of other material indebtedness. If in the future any of our other subsidiaries shall guarantee any of

our material indebtedness, such subsidiary shall also be required to guarantee the indebtedness, obligations and liabilities under this

facility.

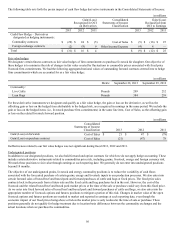

2013 Notes

In September 2008, we issued $458 million principal amount 3.25% convertible senior unsecured notes due October 15, 2013, with

interest payable semi-annually in arrears on April 15 and October 15. The 2013 Notes were originally accounted for as a combined

instrument because the conversion feature did not meet the requirements to be accounted for separately as a derivative financial

instrument. However, we adopted new accounting guidance in the first quarter of fiscal 2010 and applied it retrospectively to all

periods presented. This new accounting guidance required us to separately account for the liability and equity conversion features.

Upon retrospective adoption, our effective interest rate on the 2013 Notes was determined to be 8.26%, which resulted in the

recognition of a $92 million discount to these notes with the offsetting after tax amount of $56 million recorded to capital in excess of

par value. This discount is being accreted over the five-year term of the convertible notes at the effective interest rate.

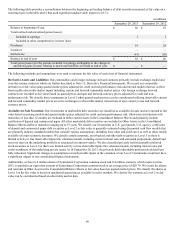

In connection with the issuance of the 2013 Notes, we entered into separate convertible note hedge transactions with respect to our

Class A stock to minimize the potential economic dilution upon conversion of the 2013 Notes. We also entered into separate warrant

transactions. We recorded the purchase of the note hedge transactions as a reduction to capital in excess of par value, net of $36

million pertaining to the related deferred tax asset, and we recorded the proceeds of the warrant transactions as an increase to capital in

excess of par value. Subsequent changes in fair value of these instruments are not recognized in the financial statements as long as the

instruments continue to meet the criteria for equity classification.

We purchased call options in private transactions for $94 million that permit us to acquire up to approximately 27 million shares of our

Class A stock at the current strike price of $16.78 per share, subject to adjustment. The call options allow us to acquire a number of

shares of our Class A stock initially equal to the number of shares of Class A stock issuable to the holders of the 2013 Notes upon

conversion. These call options contractually expire upon the maturity of the 2013 Notes. We sold warrants in private transactions for

total proceeds of $44 million. The warrants permit the purchasers to acquire up to approximately 27 million shares of our Class A

stock at the current exercise price of $22.16 per share, subject to adjustment. The warrants are exercisable on various dates from

January 2014 through April 2014.

The convertible note hedge and warrant transactions, in effect, increased the conversion price of the 2013 Notes from $16.78 per share

to $22.16 per share, thus reducing the potential future economic dilution associated with conversion of the 2013 Notes. If our share

price is below $22.16 upon exercise of the warrants, there is no economic net share impact. A 10% increase in our share price above

the $22.16 warrant exercise price would result in the issuance of 2.5 million incremental shares. At $28.60, our closing share price on

September 28, 2013, the incremental shares we would be required to issue upon exercise of the warrants would have resulted in 6.1

million shares. The 2013 Notes and the warrants have a dilutive effect on our earnings per share to the extent the price of our Class A

stock during a given measurement period exceeds the respective exercise prices of those instruments. The call options are excluded

from the calculation of diluted earnings per share as their impact is anti-dilutive.

The 2013 Notes matured on October 15, 2013 at which time we paid the $458 million principal value with cash on hand, and settled

the conversion premium by issuing 11.7 million shares of our Class A stock from available treasury shares. Simultaneous to the

settlement of the conversion premium, we received 11.7 million shares of our Class A stock from the call options.