Tyson Foods 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

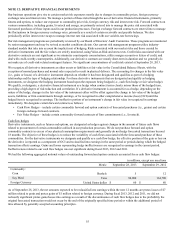

2016 Notes

On February 24, 2011, S&P upgraded the credit rating of these notes from "BB+" to "BBB-." On March 29, 2011, Moody’s upgraded

our credit rating from "Ba2" to "Ba1." These upgrades decreased the interest rate on the 2016 Notes from 7.35% to 6.85%, effective

beginning with the six-month interest payment due April 1, 2011.

On June 7, 2012, Moody's upgraded the credit rating of these notes from "Ba1" to "Baa3." This upgrade decreased the interest rate on

the 2016 Notes from 6.85% to 6.60%, effective beginning with the six-month interest payment due October 1, 2012.

2022 Notes

In June 2012, we issued $1.0 billion of senior unsecured notes, which will mature in June 2022. The 2022 Notes carry a 4.50% interest

rate, with interest payments due semi-annually on June 15 and December 15. After the original issue discount of $5 million, based on

an issue price of 99.458%, we received net proceeds of $995 million. In addition, we incurred offering expenses of $9 million.

GO Zone Tax-Exempt Bonds

In October 2008, Dynamic Fuels received $100 million in proceeds from the sale of Gulf Opportunity Zone tax-exempt bonds made

available by the federal government to the regions affected by Hurricanes Katrina and Rita in 2005. These floating rate bonds are due

October 1, 2033. We issued a letter of credit to effectively guarantee the bond issuance. If any amounts are disbursed related to this

guarantee, we would seek recovery of 50% (up to $50 million) from Syntroleum Corporation, our joint venture partner, in accordance

with our 2008 warrant agreement with Syntroleum Corporation.

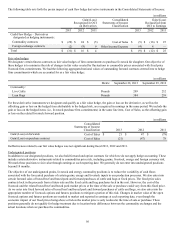

Debt Covenants

Our revolving credit facility contains affirmative and negative covenants that, among other things, may limit or restrict our ability to:

create liens and encumbrances; incur debt; merge, dissolve, liquidate or consolidate; dispose of or transfer assets; change the nature of

our business; engage in certain transactions with affiliates; and enter into sale/leaseback or hedging transactions, in each case, subject

to certain qualifications and exceptions. In addition, we are required to maintain minimum interest expense coverage and maximum

debt to capitalization ratios.

Our 2022 Notes also contain affirmative and negative covenants that, among other things, may limit or restrict our ability to: create

liens; engage in certain sale/leaseback transactions; and engage in certain consolidations, mergers and sales of assets.

We were in compliance with all debt covenants at September 28, 2013.

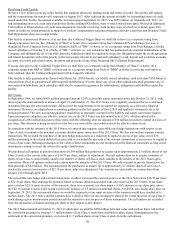

NOTE 9: INCOME TAXES

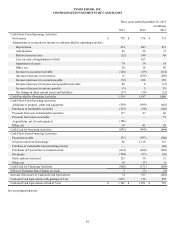

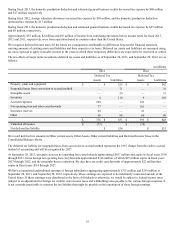

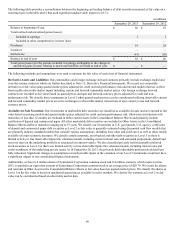

Detail of the provision for income taxes from continuing operations consists of the following:

in millions

2013 2012 2011

Federal $ 341 $ 310 $ 320

State 38 22 21

Foreign 30 19 (1)

$ 409 $ 351 $ 340

Current $ 421 $ 211 $ 254

Deferred (12) 140 86

$ 409 $ 351 $ 340

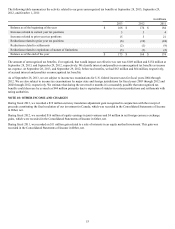

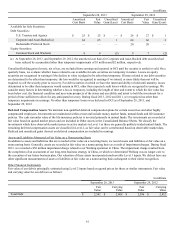

The reasons for the difference between the statutory federal income tax rate and our effective income tax rate from continuing

operations are as follows:

2013 2012 2011

Federal income tax rate 35.0% 35.0% 35.0%

State income taxes 2.4 1.5 1.6

General business credits (1.3)(0.7) (0.9)

Domestic production deduction (3.2)(1.8) (2.3)

Foreign rate differences and valuation allowances 0.3 1.8 —

Other (0.6) 0.6 (1.8)

32.6% 36.4% 31.6%