Tyson Foods 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

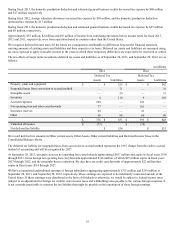

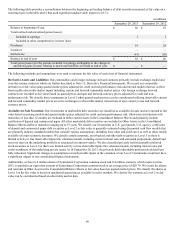

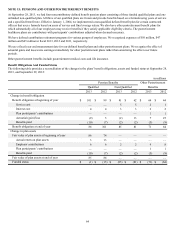

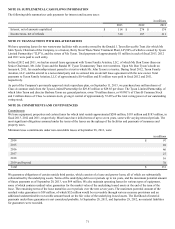

in millions

September 28, 2013 September 29, 2012

Amortized

Cost Basis Fair

Value Unrealized

Gain/(Loss) Amortized

Cost Basis Fair

Value Unrealized

Gain/(Loss)

Available for Sale Securities:

Debt Securities:

U.S. Treasury and Agency $ 25 $ 25 $ — $ 26 $ 27 $ 1

Corporate and Asset-Backed (a) 64 65 1 64 66 2

Redeemable Preferred Stock — — — 20 20 —

Equity Securities:

Common Stock and Warrants 9 4 (5) 9 7 (2)

(a) At September 28, 2013, and September 29, 2012, the amortized cost basis for Corporate and Asset-Backed debt securities had

been reduced by accumulated other than temporary impairments of $1 million and $2 million, respectively.

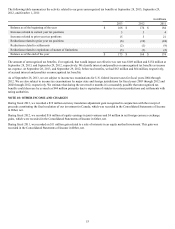

Unrealized holding gains (losses), net of tax, are excluded from earnings and reported in OCI until the security is settled or sold. On a

quarterly basis, we evaluate whether losses related to our available-for-sale securities are temporary in nature. Losses on equity

securities are recognized in earnings if the decline in value is judged to be other than temporary. If losses related to our debt securities

are determined to be other than temporary, the loss would be recognized in earnings if we intend, or more likely than not will be

required, to sell the security prior to recovery. For debt securities in which we have the intent and ability to hold until maturity, losses

determined to be other than temporary would remain in OCI, other than expected credit losses which are recognized in earnings. We

consider many factors in determining whether a loss is temporary, including the length of time and extent to which the fair value has

been below cost, the financial condition and near-term prospects of the issuer and our ability and intent to hold the investment for a

period of time sufficient to allow for any anticipated recovery. During fiscal 2013, 2012 and 2011, we recognized no other than

temporary impairments in earnings. No other than temporary losses were deferred in OCI as of September 28, 2013, and

September 29, 2012.

Deferred Compensation Assets: We maintain non-qualified deferred compensation plans for certain executives and other highly

compensated employees. Investments are maintained within a trust and include money market funds, mutual funds and life insurance

policies. The cash surrender value of the life insurance policies is invested primarily in mutual funds. The investments are recorded at

fair value based on quoted market prices and are included in Other Assets in the Consolidated Balance Sheets. We classify the

investments which have observable market prices in active markets in Level 1 as these are generally publicly-traded mutual funds. The

remaining deferred compensation assets are classified in Level 2, as fair value can be corroborated based on observable market data.

Realized and unrealized gains (losses) on deferred compensation are included in earnings.

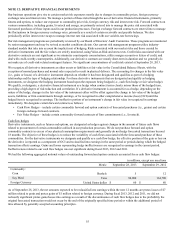

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis

In addition to assets and liabilities that are recorded at fair value on a recurring basis, we record assets and liabilities at fair value on a

nonrecurring basis. Generally, assets are recorded at fair value on a nonrecurring basis as a result of impairment charges. During fiscal

2013, we recorded a $56 million impairment charge related to our Weifang operation in China. The impairment charge resulted from

the completion of an assessment of our long-term business strategy in China, in which we determined Weifang was no longer core to

the execution of our future business plan. Our valuation of these assets incorporated unobservable Level 3 inputs. We did not have any

other significant measurements of assets or liabilities at fair value on a nonrecurring basis subsequent to their initial recognition.

Other Financial Instruments

Fair value of our debt is principally estimated using Level 2 inputs based on quoted prices for those or similar instruments. Fair value

and carrying value for our debt are as follows:

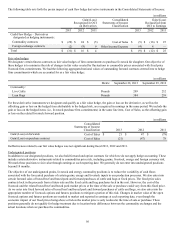

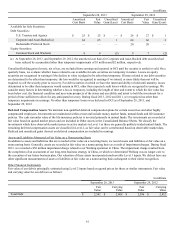

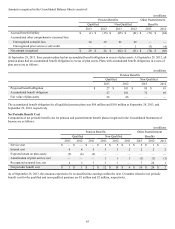

in millions

September 28, 2013 September 29, 2012

Fair

Value Carrying

Value Fair

Value Carrying

Value

Total Debt $ 2,541 $ 2,408 $ 2,596 $ 2,432