Tyson Foods 2013 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2013 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

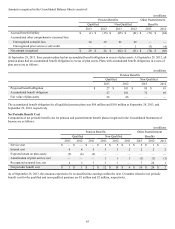

We have cash flow assistance programs in which certain livestock suppliers participate. Under these programs, we pay an amount for

livestock equivalent to a standard cost to grow such livestock during periods of low market sales prices. The amounts of such

payments that are in excess of the market sales price are recorded as receivables and accrue interest. Participating suppliers are

obligated to repay these receivables balances when market sales prices exceed this standard cost, or upon termination of the

agreement. Our maximum obligation associated with these programs is limited to the fair value of each participating livestock

supplier’s net tangible assets. The potential maximum obligation as of September 28, 2013, was approximately $340 million. The total

receivables under these programs were $44 million and $25 million at September 28, 2013, and September 29, 2012, respectively, and

are included, net of allowance for uncollectible amounts, in Accounts Receivable in our Consolidated Balance Sheets. Even though

these programs are limited to the net tangible assets of the participating livestock suppliers, we also manage a portion of our credit risk

associated with these programs by obtaining security interests in livestock suppliers’ assets. After analyzing residual credit risks and

general market conditions, we have recorded an allowance for these programs’ estimated uncollectible receivables of $15 million and

$10 million at September 28, 2013, and September 29, 2012, respectively.

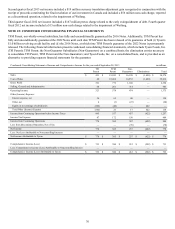

Additionally, we enter into future purchase commitments for various items, such as grains, livestock contracts and fixed grower fees.

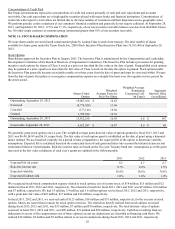

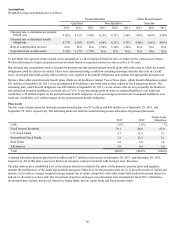

At September 28, 2013, these commitments totaled:

in millions

2014 $ 1,482

2015 54

2016 48

2017 33

2018 24

2019 and beyond 74

Total $ 1,715

Contingencies

We are involved in various claims and legal proceedings. We routinely assess the likelihood of adverse judgments or outcomes to

those matters, as well as ranges of probable losses, to the extent losses are reasonably estimable. We record accruals for such matters

to the extent that we conclude a loss is probable and the financial impact, should an adverse outcome occur, is reasonably estimable.

Such accruals are reflected in the Company’s Consolidated Financial Statements. In our opinion, we have made appropriate and

adequate accruals for these matters and believe the probability of a material loss beyond the amounts accrued to be remote; however,

the ultimate liability for these matters is uncertain, and if accruals are not adequate, an adverse outcome could have a material effect

on the consolidated financial condition or results of operations. Listed below are certain claims made against the Company and/or our

subsidiaries for which the potential exposure is considered material to the Company’s Consolidated Financial Statements. We believe

we have substantial defenses to the claims made and intend to vigorously defend these matters.

We have pending against us a lawsuit styled DeAsencio v. Tyson Foods, Inc. (E.D. Pennsylvania, August 22, 2000) in which the

plaintiffs allege that we failed to compensate certain poultry plant employees for the time it takes to engage in pre- and post-shift

activities such as changing into and out of protective and sanitary clothing and walking to and from the changing area, work areas and

break areas in violation of the Fair Labor Standards Act (FLSA). They seek back wages, liquidated damages, pre- and post-judgment

interest, and attorneys’ fees. Plaintiffs appealed a jury verdict and final judgment entered in our favor on June 22, 2006. On

September 7, 2007, the U.S. Court of Appeals for the Third Circuit reversed the jury verdict and remanded the case to the District

Court for further proceedings. We sought rehearing en banc, which was denied by the Court of Appeals on October 5, 2007. The

United States Supreme Court denied our petition for a writ of certiorari on June 9, 2008. On October 4, 2013, the District Court

ordered the parties to provide a status report within ten days or the case would be dismissed without prejudice. Neither party made

such a filing, so the case was dismissed without prejudice.