Tyson Foods 2013 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2013 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

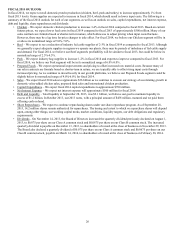

FISCAL 2014 OUTLOOK

In fiscal 2014, we expect overall domestic protein production (chicken, beef, pork and turkey) to increase approximately 1% from

fiscal 2013 levels. Grain supplies are expected to increase in fiscal 2014, which should result in lower input costs. The following is a

summary of the fiscal 2014 outlook for each of our segments, as well as an outlook on sales, capital expenditures, net interest expense,

debt and liquidity, share repurchases and dividends:

• Chicken – We expect domestic chicken production to increase 3-4% in fiscal 2014 compared to fiscal 2013. Based on current

futures prices, we expect lower feed costs in fiscal 2014 compared to fiscal 2013 of approximately $500 million. Many of our

sales contracts are formula based or shorter-term in nature, which allows us to adjust pricing when input costs fluctuate.

However, there may be a lag time for price changes to take effect. For fiscal 2014, we believe our Chicken segment will be in

or above its normalized range of 5.0%-7.0%.

• Beef – We expect to see a reduction of industry fed cattle supplies of 2-3% in fiscal 2014 as compared to fiscal 2013. Although

we generally expect adequate supplies in regions we operate our plants, there may be periods of imbalance of fed cattle supply

and demand. For fiscal 2014, we believe our Beef segment's profitability will be similar to fiscal 2013, but could be below its

normalized range of 2.5%-4.5%.

• Pork – We expect industry hog supplies to increase 1-2% in fiscal 2014 and exports to improve compared to fiscal 2013. For

fiscal 2014, we believe our Pork segment will be in its normalized range of 6.0%-8.0%.

• Prepared Foods – We expect operational improvements and pricing to offset increased raw material costs. Because many of

our sales contracts are formula based or shorter-term in nature, we are typically able to offset rising input costs through

increased pricing. As we continue to invest heavily in our growth platforms, we believe our Prepared Foods segment could be

slightly below its normalized range of 4.0%-6.0% for fiscal 2014.

• Sales – We expect fiscal 2014 sales to approximate $36 billion as we continue to execute our strategy of accelerating growth in

domestic value-added chicken sales, prepared food sales and international chicken production.

• Capital Expenditures – We expect fiscal 2014 capital expenditures to approximate $700 million.

• Net Interest Expense – We expect net interest expense will approximate $100 million for fiscal 2014.

• Debt and Liquidity – Total liquidity at September 28, 2013, was $2.1 billion, well above our goal to maintain liquidity in

excess of $1.2 billion. In October 2013, our 2013 notes, with a principal amount of $458 million, matured and we paid them

off using cash on hand.

• Share Repurchases – We expect to continue repurchasing shares under our share repurchase program. As of September 28,

2013, 14.2 million shares remain authorized for repurchases. The timing and extent to which we repurchase shares will depend

upon, among other things, our working capital needs, market conditions, liquidity targets, our debt obligations and regulatory

requirements.

• Dividends – On November 14, 2013, the Board of Directors increased the quarterly dividend previously declared on August 1,

2013, to $0.075 per share on our Class A common stock and $0.0675 per share on our Class B common stock. The increased

quarterly dividend is payable on December 13, 2013, to shareholders of record at the close of business on November 29, 2013.

The Board also declared a quarterly dividend of $0.075 per share on our Class A common stock and $0.0675 per share on our

Class B common stock, payable on March 14, 2014, to shareholders of record at the close of business on February 28, 2014.