Tyson Foods 2013 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2013 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

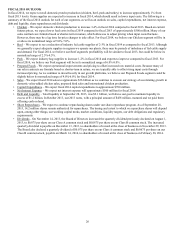

On February 11, 2013, S&P upgraded the credit rating of the 2016 Notes from "BBB-" to "BBB." This upgrade did not impact the

interest rate on the 2016 Notes.

A one-notch downgrade by Moody's would increase the interest rates on the 2016 Notes by 0.25%. A two-notch downgrade from

S&P would increase the interest rates on the 2016 Notes by 0.25%.

Revolving Credit Facility

S&P’s corporate credit rating for Tyson Foods, Inc. is "BBB." Moody’s senior, unsecured, subsidiary guaranteed long-term debt

rating for Tyson Foods, Inc. is "Baa3." Fitch Ratings', a wholly owned subsidiary of Fimalac, S.A. (Fitch), issuer default rating for

Tyson Foods, Inc. is "BBB." The below table outlines the fees paid on the unused portion of the facility (Facility Fee Rate) and

letter of credit fees (Undrawn Letter of Credit Fee and Borrowing Spread) depending on the rating levels of Tyson Foods, Inc. from

S&P, Moody's and Fitch.

Ratings Level (S&P/Moody's/Fitch) Facility Fee

Rate

Undrawn Letter of

Credit Fee and

Borrowing Spread

BBB+/Baa1/BBB+ or above 0.150% 1.125%

BBB/Baa2/BBB (current level) 0.175% 1.375%

BBB-/Baa3/BBB- 0.225% 1.625%

BB+/Ba1/BB+ 0.275% 1.875%

BB/Ba2/BB or lower or unrated 0.325% 2.125%

In the event the rating levels are split, the applicable fees and spread will be based upon the rating level in effect for two of the

rating agencies, or, if all three rating agencies have different rating levels, the applicable fees and spread will be based upon the

rating level that is between the rating levels of the other two rating agencies.

Debt Covenants

Our revolving credit facility contains affirmative and negative covenants that, among other things, may limit or restrict our ability

to: create liens and encumbrances; incur debt; merge, dissolve, liquidate or consolidate; dispose of or transfer assets; change the

nature of our business; engage in certain transactions with affiliates; and enter into sale/leaseback or hedging transactions, in each

case, subject to certain qualifications and exceptions. In addition, we are required to maintain minimum interest expense coverage

and maximum debt to capitalization ratios.

Our 2022 Notes also contain affirmative and negative covenants that, among other things, may limit or restrict our ability to: create

liens; engage in certain sale/leaseback transactions; and engage in certain consolidations, mergers and sales of assets.

We were in compliance with all debt covenants at September 28, 2013.

OFF-BALANCE SHEET ARRANGEMENTS

We do not have any off-balance sheet arrangements material to our financial position or results of operations. The off-balance sheet

arrangements we have are guarantees of debt of outside third parties, including a lease and grower loans, and residual value guarantees

covering certain operating leases for various types of equipment. See Part II, Item 8, Notes to Consolidated Financial Statements, Note

20: Commitments and Contingencies for further discussion.