Tyson Foods 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

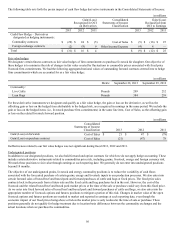

Assumptions

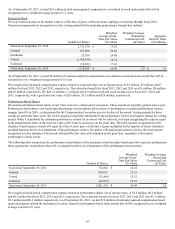

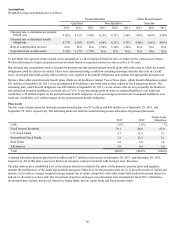

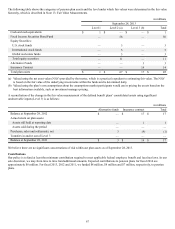

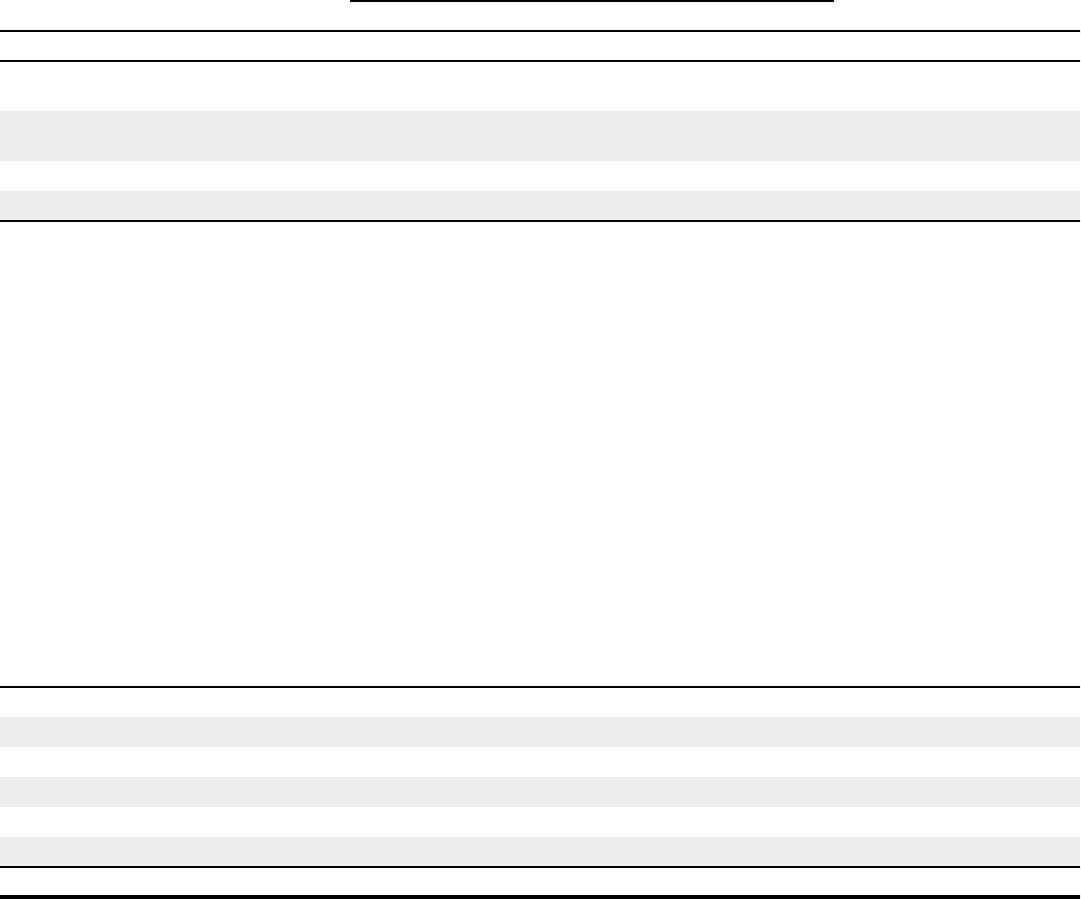

Weighted average assumptions are as follows:

Pension Benefits Other Postretirement

Qualified Non-Qualified Benefits

2013 2012 2011 2013 2012 2011 2013 2012 2011

Discount rate to determine net periodic

benefit cost 4.02% 4.53% 5.06% 4.23% 4.75% 5.50% 3.66% 4.09% 4.50%

Discount rate to determine benefit

obligations 4.77% 4.02% 4.53% 5.09% 4.23% 4.75% 4.48% 3.66% 4.09%

Rate of compensation increase N/A N/A N/A 3.50% 3.50% 3.50% N/A N/A N/A

Expected return on plan assets 5.44% 6.37% 7.79% N/A N/A N/A N/A N/A N/A

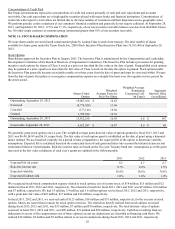

To determine the expected return on plan assets assumption, we first examined historical rates of return for the various asset classes.

We then determined a long-term projected rate-of-return based on expected returns over the next five to 10 years.

Our discount rate assumptions used to account for pension and other postretirement benefit plans reflect the rates at which the benefit

obligations could be effectively settled. These were determined using a cash flow matching technique whereby the rates of a yield

curve, developed from high-quality debt securities, were applied to the benefit obligations to determine the appropriate discount rate.

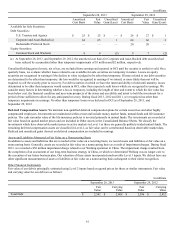

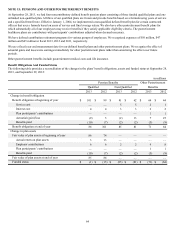

We have three other postretirement benefit plans which are all healthcare related. Two of these plans, which benefit obligations totaled

$23 million at September 28, 2013, were not impacted by healthcare cost trend rates as they consist of fixed annual payments. The

remaining plan, which benefit obligation was $48 million at September 28, 2013, covers retirees who do not yet qualify for Medicare

and utilized an assumed healthcare cost trend rate of 7.6%. A one-percentage point increase in assumed healthcare cost trend rate

would have a $9 million impact on the postretirement benefit obligation. A one-percentage point decrease in assumed healthcare cost

trend rate would have a $5 million impact on the postretirement benefit obligation.

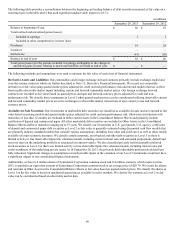

Plan Assets

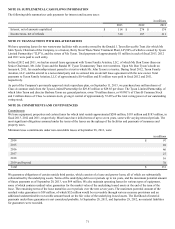

The fair value of plan assets for domestic pension benefit plans was $71 million and $69 million as of September 28, 2013, and

September 29, 2012, respectively. The following table sets forth the actual and target asset allocation for pension plan assets:

2013 2012 Target Asset

Allocation

Cash 1.6% 1.6% —%

Fixed Income Securities 79.1 46.0 83.0

U.S. Stock Funds 4.3 23.5 5.1

International Stock Funds 7.3 23.5 5.1

Real Estate 3.8 5.0 3.4

Alternatives 3.9 0.4 3.4

Total 100.0% 100.0% 100.0%

A foreign subsidiary pension plan had $14 million and $17 million in plan assets at September 28, 2013, and September 29, 2012,

respectively. All of this plan’s assets are held in an insurance contract consistent with its target asset allocation.

The plan trustees have established a set of investment objectives related to the assets of the domestic pension plans and regularly

monitor the performance of the funds and portfolio managers. Objectives for the pension assets are (i) to provide growth of capital and

income, (ii) to achieve a target weighted average annual rate of return competitive with other funds with similar investment objectives

and (iii) to diversify to reduce risk. The investment objectives and target asset allocation were amended for fiscal 2013. Alternative

investments may include, but are not limited to, hedge funds, private equity funds and fixed income funds.