TripAdvisor 2013 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2013 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

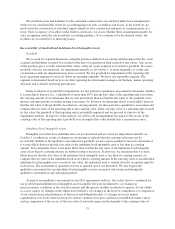

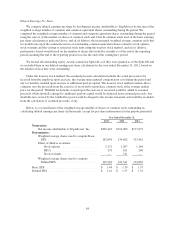

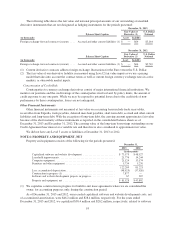

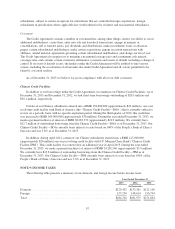

A summary of the status and activity for stock option awards relating to our common stock for the year

ended December 31, 2013, is presented below:

Options

Outstanding

Weighted

Average

Exercise

Price Per

Share

Weighted

Average

Remaining

Contractual

Life

Aggregate

Intrinsic

Value

(In thousands) (In years) (In thousands)

Options outstanding at January 1, 2013 ................ 8,654 $31.41

Granted ......................................... 2,825 58.03

Exercised (1) ..................................... 1,487 23.81

Cancelled or expired ............................... 522 38.09

Options outstanding at December 31, 2013 ............. 9,470 $40.18 5.9 $403,828

Exercisable as of December 31, 2013 .................. 3,533 $30.11 3.0 $186,273

Vested and expected to vest after December 31, 2013 ..... 8,731 $39.94 5.7 $374,487

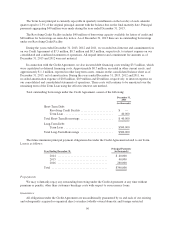

(1) Inclusive of 242,767 options which were not converted into shares due to net share settlement in order to

cover the aggregate exercise price and the minimum amount of required employee withholding taxes.

Potential shares which had been convertible under stock options that were withheld under net share

settlement remain in the authorized but unissued pool under the 2011 Incentive Plan and can be reissued by

the Company. We began net-share settling the majority of our stock option exercises during the third quarter

of 2013. Total payments for the employees’ tax obligations to the taxing authorities due to net share

settlements are reflected as a financing activity within the consolidated statements of cash flows.

Aggregate intrinsic value represents the difference between the closing stock price of our common stock and

the exercise price of outstanding, in-the-money options. Our closing stock price as reported on NASDAQ as of

December 31, 2013 was $82.83. The total intrinsic value of stock options exercised for the years ended

December 31, 2013 and 2012 were $58.2 million and $25.1 million, respectively. No stock options were

exercised between Spin-Off and December 31, 2011.

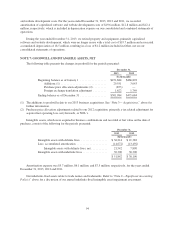

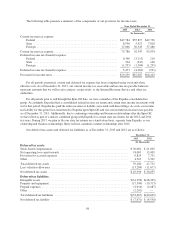

The fair value of stock option grants under the 2011 Incentive Plan has been estimated at the date of grant

using the Black–Scholes option pricing model with the following weighted average assumptions for the periods

presented:

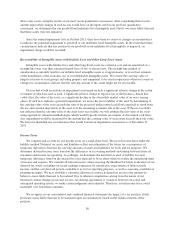

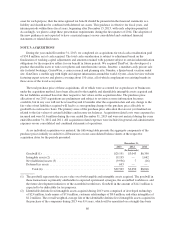

December 31,

2013 2012

Risk free interest rate .......................... 1.41% 1.03%

Expected term (in years) ........................ 6.06 6.21

Expected volatility ............................. 50.78% 53.46%

Expected dividend yield ........................ — % — %

The weighted-average grant date fair value of options granted was $28.30 and $20.36 for the years ended

December 31, 2013 and 2012, respectively. No stock options were granted under the 2011 Incentive Plan for the

year ended December 31, 2011. The total fair value of stock options vested for the years ended December 31,

2013 and 2012 were $26.6 million and $9.8 million, respectively. No stock options were vested between

Spin-Off and December 31, 2011.

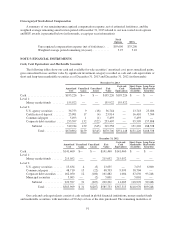

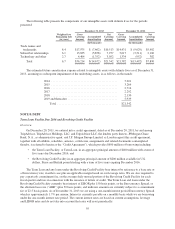

2013 RSU Activity

During the year ended December 31, 2013, we issued 1,148,976 RSUs under the 2011 Incentive Plan for

which the fair value was measured based on the quoted price of our common stock. These RSUs generally vest

over a four-year requisite service period. We will amortize the fair value of the 2013 grants, net of estimated

89