TripAdvisor 2013 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2013 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

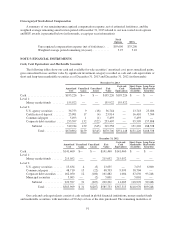

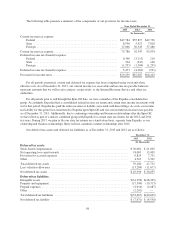

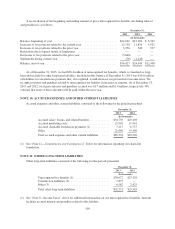

The following table presents a summary of the components of our provision for income taxes:

Year Ended December 31,

2013 2012 2011

(In thousands)

Current income tax expense:

Federal ....................................................... $47,784 $55,877 $49,736

State ......................................................... 8,936 5,927 7,818

Foreign ....................................................... 17,066 30,543 37,480

Current income tax expense ........................................... 73,786 92,347 95,034

Deferred income tax (benefit) expense:

Federal ....................................................... 6,366 (3,113) 216

State ......................................................... 704 (347) 148

Foreign ....................................................... (1,597) (1,500) (1,295)

Deferred income tax (benefit) expense: .................................. 5,473 (4,960) (931)

Provision for income taxes ............................................ $79,259 $87,387 $94,103

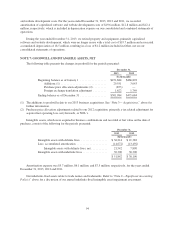

For all periods presented, current and deferred tax expense has been computed using our stand-alone

effective rate. As of December 31, 2013, our current income tax receivable and income tax payable balances

represent amounts that we will receive and pay, respectively, to the Internal Revenue Service and other tax

authorities.

For all periods prior to and through the Spin-Off date, we were a member of the Expedia consolidated tax

group. Accordingly, Expedia filed a consolidated federal income tax return and certain state income tax returns with

us for that period. Expedia has paid the entire income tax liability associated with these filings. As such, our income

tax liability for this period was transferred to Expedia upon Spin-Off and was not included in income taxes payable

as of December 31, 2011. Additionally, due to continuing ownership and business relationships after the Spin-Off,

we have filed as part of a unitary combined group with Expedia for certain state tax returns for the 2012 and 2011

tax years. During 2013, we plan to file our state tax returns on a stand-alone basis, separate from Expedia, as our

ownership and business relationships likely will not constitute a unitary relationship after 2012.

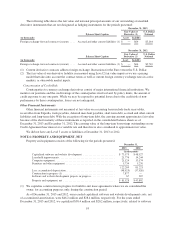

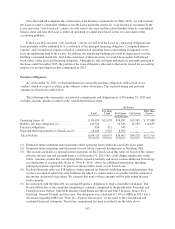

Our deferred tax assets and deferred tax liabilities as of December 31, 2013 and 2012 are as follows:

December 31,

2013 2012

(In thousands)

Deferred tax assets:

Stock-based compensation ................................................... $30,081 $ 21,605

Net operating loss carryforwards .............................................. 18,005 15,005

Provision for accrued expenses ............................................... 6,829 7,731

Other .................................................................... 4,365 3,391

Total deferred tax assets ..................................................... 59,280 47,732

Less valuation allowance .................................................... (13,284) (11,677)

Net deferred tax assets ...................................................... $45,996 $ 36,055

Deferred tax liabilities:

Intangible assets ........................................................... $(31,956) $(28,205)

Property and equipment ..................................................... (17,500) (10,313)

Prepaid expenses ........................................................... (2,010) (2,087)

Other .................................................................... (2,201) —

Total deferred tax liabilities .................................................. $(53,667) $(40,605)

Net deferred tax liability ..................................................... $ (7,671) $ (4,550)

98