TripAdvisor 2013 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2013 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

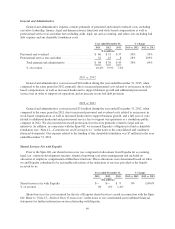

$326 million in 2013. This was primarily offset by an increase in the purchases of marketable securities by $213

million, cash paid for 2013 business acquisitions of $35 million, net of cash acquired, and an increase in capital

expenditures of $26 million. In addition, we received $7 million during the three months ended March 31, 2012

from Expedia related to Spin-Off, which did not reoccur in 2013.

Financing Activities

For the year ended December 31, 2013, net cash provided by financing activities decreased by $360 million

when compared to the same period in 2012 primarily due to an increase of $20 million in principal payments on

our Term Loan, payments of $145 million for common stock share repurchases under our authorized share

repurchase program, a reduction of $207 million in proceeds related to the exercise of our stock options and

warrants, primarily due to one-time warrant proceeds of $215 million during 2012 and the introduction in Q3

2013 of the net share settlement of our stock option exercises, and a $15 million repayment of our outstanding

borrowings on our Chinese Credit Facilities in 2013. This was offset by a $10 million repayment of our

outstanding borrowing on our Revolving Credit Facility in 2012 that did not reoccur in 2013 and $22 million

paid to purchase the remaining shares of our non-controlling interest in 2012 that did not reoccur in 2013.

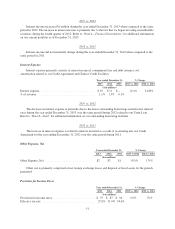

2012 vs. 2011

Operating Activities

For the year ended December 31, 2012, net cash provided by operating activities increased by $21 million or

10% when compared to the same period in 2011, primarily due to an increase in net income of $17 million and

an increase in non-cash items not affecting cash flows of $9 million, which is primarily related to increased stock

based compensation, offset by a decrease in working capital movements of $5 million. The decrease in working

capital movements in 2012 vs. 2011 was primarily driven by the classification of activity with Expedia of $17

million which was classified in operating activities in 2012, as compared to investing activities in the periods

prior to the Spin-Off, offset by the timing of customer cash receipts and the timing of tax and vendor payments.

Investing Activities

For the year ended December 31, 2012, net cash provided by investing activities increased by $295 million

when compared to the same period in 2011, primarily due to the cessation of net cash transfers to Expedia related

to business operations in the periods prior to the Spin-Off in 2011 of $96 million and a distribution of

approximately $406 million to Expedia immediately prior to the Spin-Off in 2011. This was primarily offset by

the purchase of $219 million of marketable securities in 2012, as we began purchasing debt securities in the

fourth quarter of 2012.

Financing Activities

For the year ended December 31, 2012, net cash provided by financing activities decreased by $222 million

when compared to the same period in 2011 primarily due to funding related to our term loan facility borrowing in

conjunction with the Spin-Off of $400 million in 2011. This was offset by proceeds from the exercise of our

stock options and warrants of $231 million, net of payment of minimum withholding taxes related to the

settlement of equity awards of $7 million in 2012. In addition we paid $20 million in principal payments on our

Term Loan, a $10 million repayment of our outstanding borrowing on our Revolving Credit Facility, and paid

$22 million to purchase the remaining shares of our noncontrolling interest in 2012.

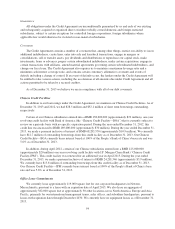

Off-Balance Sheet Arrangements

As of December 31, 2013, we did not have any off-balance sheet arrangements, as defined in

Item 303(a)(4)(ii) of Regulation S-K of the SEC, that have, or are reasonably likely to have, a current or future

effect on our financial condition, results of operations, liquidity, capital expenditures or capital resources.

57