TripAdvisor 2013 Annual Report Download - page 102

Download and view the complete annual report

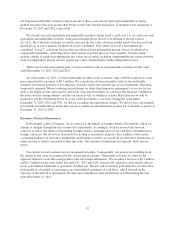

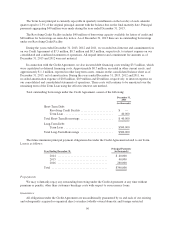

Please find page 102 of the 2013 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.our long-term marketable securities range from one to three years and our short-term marketable securities

include maturities that were greater than 90 days at the date purchased and have 12 months or less remaining at

December 31, 2013 and 2012, respectively.

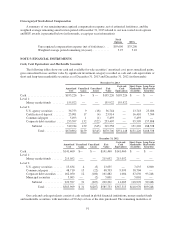

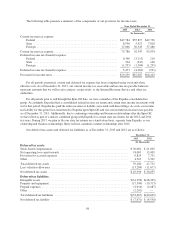

We classify our cash equivalents and marketable securities within Level 1 and Level 2 as we value our cash

equivalents and marketable securities using quoted market prices (Level 1) or alternative pricing sources

(Level 2). The valuation technique we used to measure the fair value of money market funds were derived from

quoted prices in active markets for identical assets or liabilities. Fair values for Level 2 investments are

considered “Level 2” valuations because they are obtained from independent pricing sources for identical or

comparable instruments, rather than direct observations of quoted prices in active markets. Our procedures

include controls to ensure that appropriate fair values are recorded, including comparing the fair values obtained

from our independent pricing services against fair values obtained from another independent source.

There were no material realized gains or losses related to sales of our marketable securities for the years

ended December 31, 2013, 2012 and 2011.

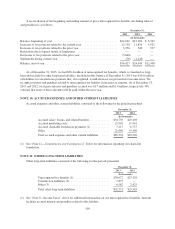

As of December 31, 2013, we have marketable securities with a total fair value of $168.8 million in a total

gross unrealized loss position of $0.3 million. We consider the declines in market value of our marketable

securities investment portfolio to be temporary in nature and do not consider any of our investments other-than-

temporarily impaired. When evaluating an investment for other-than-temporary impairment, we review factors

such as the length of time and extent to which fair value has been below its cost basis, the financial condition of

the issuer and any changes thereto, and the our intent to sell, or whether it is more likely than not we will be

required to sell the investment before recovery of the investment’s cost basis. During the years ended

December 31, 2013, 2012 and 2011, we did not recognize any impairment charges. We did not have any material

investments in marketable securities that were in a continuous unrealized loss position for 12 months or greater at

December 31, 2013 or 2012.

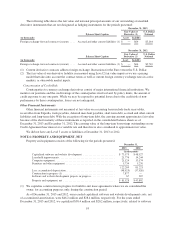

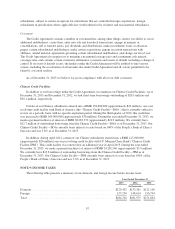

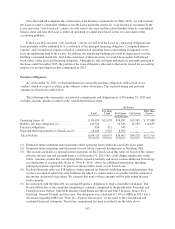

Derivative Financial Instruments

In the normal course of business, we are exposed to the impact of foreign currency fluctuations, which we

attempt to mitigate through the use of derivative instruments. Accordingly, we have entered into forward

contracts to reduce the effects of fluctuating foreign currency exchange rates on our cash flows denominated in

foreign currencies. We do not use derivatives for trading or speculative purposes. In accordance with current

accounting guidance on derivative instruments and hedging activities, we record all our derivative instruments as

either an asset or liability measured at their fair value. Our derivative instruments are typically short-term in

nature.

Our current forward contracts are not designated as hedges. Consequently, any gain or loss resulting from

the change in fair value is recognized in the current period earnings. These gains or losses are offset by the

exposure related to receivables and payables with our foreign subsidiaries. We recorded a net loss of $0.3 million

and $0.7 million for the years ended December 31, 2013 and 2012, respectively, related to our forward contracts

in our consolidated statements of operations in Other, net. The net cash received or paid related to our derivative

instruments are classified as operating in our consolidated statements of cash flows, which is based on the

objective of the derivative instruments. No derivative instruments were entered into or settled during the year

ended December 31, 2011.

92