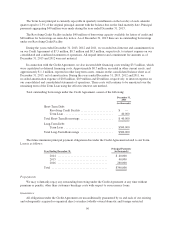

TripAdvisor 2013 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2013 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

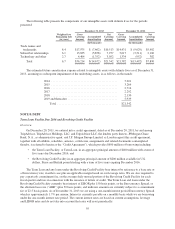

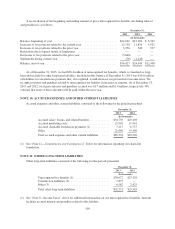

and website development costs. For the years ended December 31, 2013, 2012 and 2011, we recorded

amortization of capitalized software and website development costs of $19.6 million, $12.8 million and $12.4

million, respectively, which is included in depreciation expense on our consolidated and combined statements of

operations.

During the year ended December 31, 2013, we retired property and equipment, primarily capitalized

software and website development, which were no longer in use with a total cost of $19.7 million and associated

accumulated depreciation of 18.5 million, resulting in a loss of $1.2 million included in Other, net on our

consolidated statements of operations.

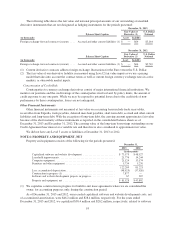

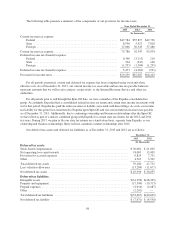

NOTE 7: GOODWILL AND INTANGIBLE ASSETS, NET

The following table presents the changes in goodwill for the periods presented:

December 31,

2013 2012

(In thousands)

Beginning balance as of January 1 .................. $471,684 $466,892

Additions (1) ............................... 29,551 3,043

Purchase price allocation adjustments (2) ......... (873) —

Foreign exchange translation adjustment ......... 1,622 1,749

Ending balance as of December 31 .................. $501,984 $471,684

(1) The additions to goodwill relate to our 2013 business acquisitions. See “Note 3— Acquisitions,” above for

further information.

(2) Purchase price allocation adjustments related to our 2012 acquisition, primarily a tax related adjustment for

acquired net operating loss carryforwards, or NOL’s.

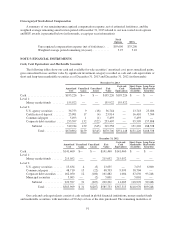

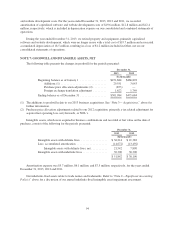

Intangible assets, which were acquired in business combinations and recorded at fair value on the date of

purchase, consist of the following for the periods presented:

December 31,

2013 2012

(In thousands)

Intangible assets with definite lives .................. $36,214 $ 21,382

Less: accumulated amortization ..................... (14,672) (13,492)

Intangible assets with definite lives, net ........... 21,542 7,890

Intangible assets with indefinite lives ................. 30,300 30,300

$ 51,842 $ 38,190

Amortization expense was $5.7 million, $6.1 million, and $7.5 million, respectively, for the years ended

December 31, 2013, 2012 and 2011.

Our indefinite-lived assets relate to trade names and trademarks. Refer to “Note 2—Significant Accounting

Policies” above for a discussion of our annual indefinite-lived intangible asset impairment assessment.

94