TripAdvisor 2013 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2013 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

asset for such purpose, then the unrecognized tax benefit should be presented in the financial statements as a

liability and should not be combined with deferred tax assets. This guidance is effective for fiscal years, and

interim periods within those fiscal years, beginning after December 15, 2013, with early adoption permitted.

Accordingly, we plan to adopt these presentation requirements during the first quarter of 2014. The adoption of

this new guidance is not expected to have a material impact on our consolidated and combined financial

statements or related disclosures.

NOTE 3: ACQUISITIONS

During the year ended December 31, 2013, we completed six acquisitions for total cash consideration paid

of $34.8 million, net of cash acquired. The total cash consideration is subject to adjustment based on the

finalization of working capital adjustments and amounts retained with payment subject to certain indemnification

obligations by the respective sellers for our benefit in future periods. We acquired TinyPost, the developer of a

product that enables users to write over photos and turn them into stories, Jetsetter, a members-only private sale

site for hotel bookings; CruiseWise, a cruise research and planning site; Niumba, a Spain-based vacation rental

site; GateGuru, a mobile app with flight and airport information around the world; Oyster, a hotel review website

featuring expert reviews and photos covering about 150 cities, all of which complement our existing brands in

those areas of the travel ecosystem.

The total purchase price of these acquisitions, all of which were accounted for as purchases of businesses

under the acquisition method, have been allocated to the tangible and identifiable intangible assets acquired and

the net liabilities assumed based on their respective fair values on the acquisition date. The purchase price

allocation of our 2013 acquisitions are preliminary and subject to revision as more information becomes

available, but in any case will not be revised beyond 12 months after the acquisition date and any change to the

fair value of net liabilities acquired will lead to a corresponding change to the purchase price allocable to

goodwill on a retroactive basis. The primary areas of the purchase price allocation that are not yet finalized are

related to the fair values of certain liabilities and income tax balances. Acquisition-related costs were expensed as

incurred and were $1.6 million during the year ended December 31, 2013 and were not material during the years

ended December 31, 2012 and 2011. All acquisition related expenses were included in general and administrative

expenses on our consolidated and combined statements of operations.

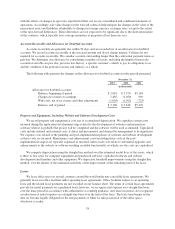

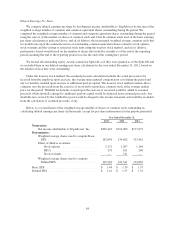

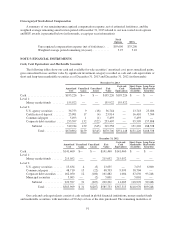

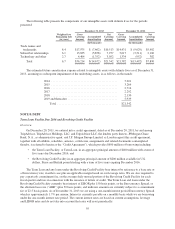

As no individual acquisition was material, the following table presents the aggregate components of the

purchase prices initially recorded for all businesses on our consolidated balance sheets at the respective

acquisition dates for the periods presented:

December 31,

2013 2012 2011

(In thousands)

Goodwill (1) .............................................. $29,551 $3,043 $6,390

Intangible assets (2) ........................................ 19,195 — 1,642

Net (liabilities)/assets (3) .................................... (9,936) 7 (16)

Deferred tax assets ......................................... 693 — —

Total (4) ............................................. $39,503 $3,050 $8,016

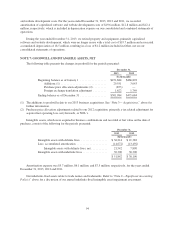

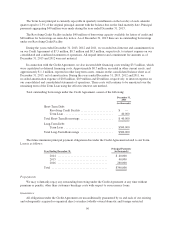

(1) The goodwill represents the excess value over both tangible and intangible assets acquired. The goodwill in

these transactions is primarily attributable to expected operational synergies, the assembled workforces, and

the future development initiatives of the assembled workforces. Goodwill in the amount of $14.1 million is

expected to be deductible for tax purposes.

(2) Identifiable definite-lived intangible assets acquired during 2013 were comprised of developed technology

of $2.4 million, trade names of $7.6 million, customer relationships of $8.0 million, and other intangibles of

$1.2 million. The overall weighted-average life of the identifiable definite-lived intangible assets acquired in

the purchase of the companies during 2013 was 8.0 years, which will be amortized on a straight-line basis

86