TripAdvisor 2013 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2013 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

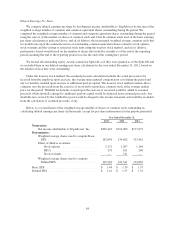

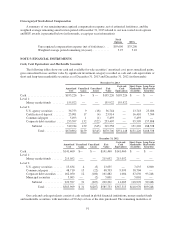

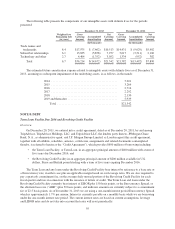

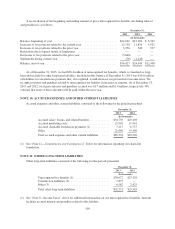

Unrecognized Stock-Based Compensation

A summary of our remaining unrecognized compensation expense, net of estimated forfeitures, and the

weighted average remaining amortization period at December 31, 2013 related to our non-vested stock options

and RSU awards is presented below (in thousands, except per year information):

Stock

Options RSUs

Unrecognized compensation expense (net of forfeitures) . . . $93,696 $33,200

Weighted average period remaining (in years) ........... 3.27 3.10

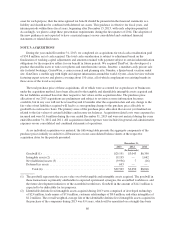

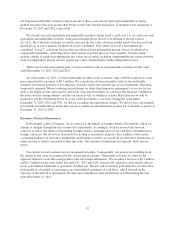

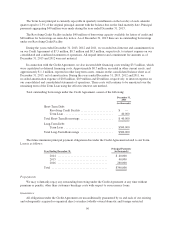

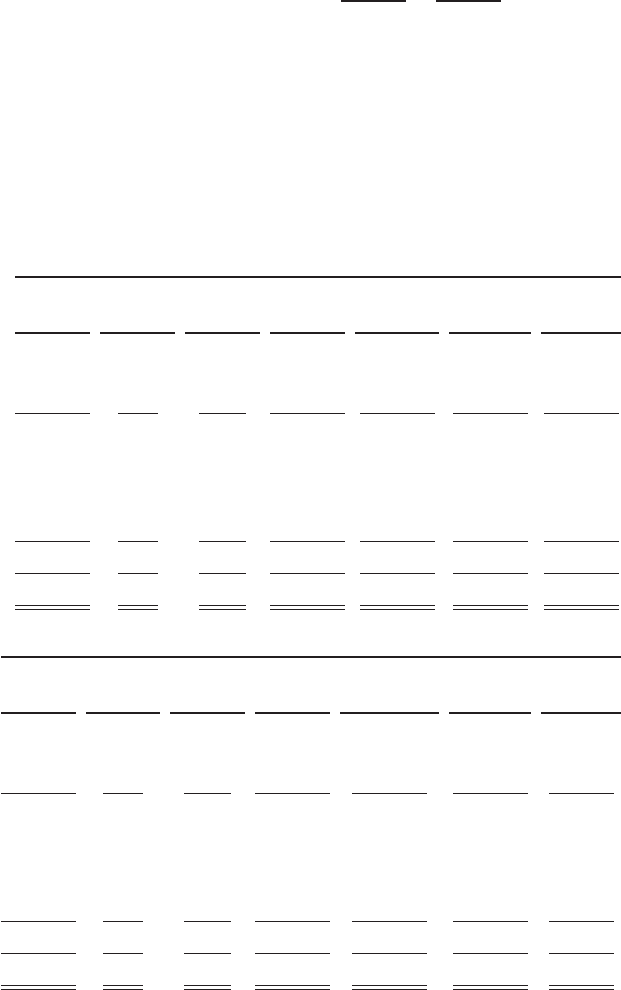

NOTE 5: FINANCIAL INSTRUMENTS

Cash, Cash Equivalents and Marketable Securities

The following tables show our cash and available-for-sale securities’ amortized cost, gross unrealized gains,

gross unrealized losses and fair value by significant investment category recorded as cash and cash equivalents or

short and long-term marketable securities as of December 31, 2013 and December 31, 2012 (in thousands):

December 31, 2013

Amortized

Cost

Unrealized

Gains

Unrealized

Losses

Fair

Value

Cash and

Cash

Equivalents

Short-Term

Marketable

Securities

Long-Term

Marketable

Securities

Cash ......................... $195,226 $— $ — $195,226 $195,226 $ — $ —

Level 1:

Money market funds ........ 155,922 — — 155,922 155,922 — —

Level 2:

U.S. agency securities ....... 36,753 9 (18) 36,744 — 13,718 23,026

Certificates of deposit ....... 23,901 17 (4) 23,914 — 16,410 7,504

Commercial paper .......... 5,493 1 (1) 5,493 — 5,493 —

Corporate debt securities ..... 253,597 132 (322) 253,407 — 95,599 157,808

Subtotal .............. 319,744 159 (345) 319,558 — 131,220 188,338

Total ............. $670,892 $159 $(345) $670,706 $351,148 $131,220 $188,338

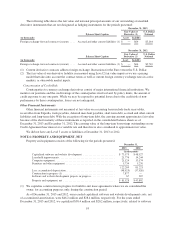

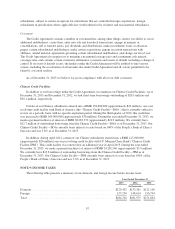

December 31, 2012

Amortized

Cost

Unrealized

Gains

Unrealized

Losses

Fair

Value

Cash and

Cash

Equivalents

Short-Term

Marketable

Securities

Long-Term

Marketable

Securities

Cash ........................ $141,460 $— $ — $141,460 $141,460 $ — $ —

Level 1:

Money market funds ....... 215,052 — — 215,052 215,052 — —

Level 2:

U.S. agency securities ...... 13,634 4 (3) 13,635 — 7,635 6,000

Commercial paper ......... 48,710 15 (22) 48,703 9,999 38,704 —

Corporate debt securities .... 162,050 12 (180) 161,882 1,004 67,630 93,248

Municipal securities ....... 5,003 — (2) 5,001 — 5,001 —

Subtotal ............. 229,397 31 (207) 229,221 11,003 118,970 99,248

Total ........... $585,909 $ 31 $(207) $585,733 $367,515 $118,970 $99,248

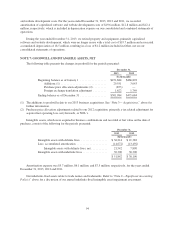

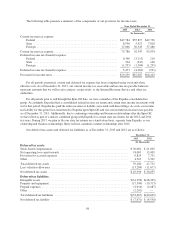

Our cash and cash equivalents consist of cash on hand in global financial institutions, money market funds

and marketable securities, with maturities of 90 days or less at the date purchased. The remaining maturities of

91