TripAdvisor 2013 Annual Report Download - page 111

Download and view the complete annual report

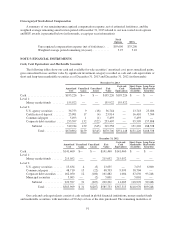

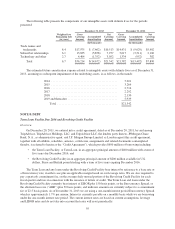

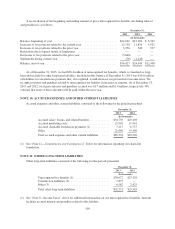

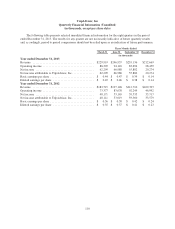

Please find page 111 of the 2013 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(2) We capitalize construction in progress and record a corresponding long-term liability for build-to-suit lease

agreements where we are considered the owner during the construction period for accounting purposes only.

(3) Amounts primarily consist of long term deferred rent balances related to operating leases for office space.

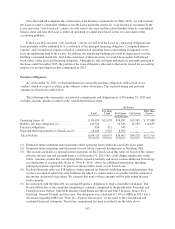

NOTE 12: COMMITMENTS AND CONTINGENCIES

We have commitments and obligations that include office space leases, vendor purchase obligations and

expected interest on long-term debt, which are not accrued on the consolidated balance sheet at December 31,

2013 but we expect to require future cash outflows and in some cases may be accelerated upon demand of a third

party upon certain contingent events.

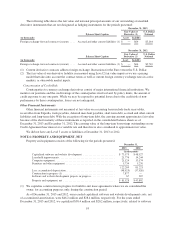

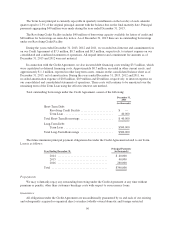

Office Lease Commitments

We have contractual obligations in the form of operating leases for office space for which we record the

related expense on a monthly basis. Certain leases contain periodic rent escalation adjustments and renewal

options. Rent expense related to such leases is recorded on a straight-line basis. Operating lease obligations

expire at various dates with the latest maturity in December 2030. For the years ended December 31, 2013, 2012

and 2011, we recorded rental expense of $10.9 million, $7.8 million and $6.0 million, respectively.

We currently lease approximately 119,000 square feet for our corporate headquarters in Newton,

Massachusetts, pursuant to a lease with an expiration date of April 2015. We also lease an aggregate of

approximately 382,000 square feet at approximately 30 other locations across North America, Europe and Asia

Pacific, primarily for our international management teams, sales offices, and subsidiary headquarters, pursuant to

leases with expiration dates through December 2030.

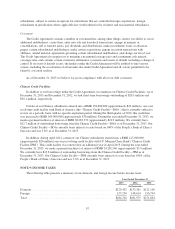

In June 2013, TripAdvisor LLC (“TA LLC”), our indirect, wholly owned subsidiary, entered into a lease

(the “Lease”), for a new corporate headquarters. Pursuant to the Lease, the landlord will build an approximately

280,000 square foot rental building in Needham, Massachusetts (the “Premises”), and thereafter lease the

Premises to TA LLC as TripAdvisor’s new corporate headquarters for an initial term of 15 years and 7 months. If

the landlord fails to deliver the Premises according to the schedule, subject to certain conditions, TA LLC may be

entitled to additional free rent, or in extreme cases, a right to terminate the Lease. Under the Lease, TA LLC is

required to pay an initial base rent of $33.00 per square foot per year, increasing to $34.50 per square foot by the

final year of the initial term, as well as all real estate taxes and other building operating costs. TA LLC also has

an option to extend the term of the Lease for two consecutive terms of five years each.

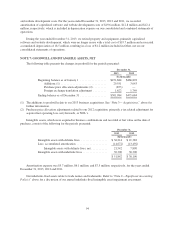

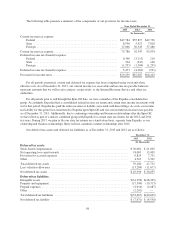

The aggregate future minimum lease payments are $143.5 million and are currently scheduled to be paid,

beginning in November 2015, as follows: $1.1 million for 2015, $9.3 million for 2016, $9.3 million for 2017,

$9.3 million for 2018 and $114.6 million for 2019 and thereafter. The Lease has escalating rental payments and

initial periods of free rent. TA LLC was also obligated to deliver a letter of credit to the Landlord in the amount

of $0.8 million as security deposit, which amount is subject to increase under certain circumstances. TA LLC

also has an option to extend the term of the Lease for two consecutive terms of five years each. Subject to certain

conditions, TA LLC has certain rights under the Lease, including rights of first offer to lease additional space or

to purchase the Premises if the Landlord elects to sell. In connection with the Lease, TripAdvisor entered into a

Guaranty (the “Guaranty”), pursuant to which TripAdvisor provides full payment and performance guaranty for

all of TA LLC’s obligations under the Lease.

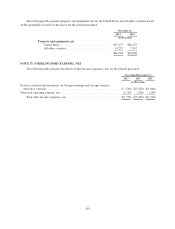

We have concluded we are the deemed owner (for accounting purposes only) of the Premises during the

construction period under build to suit lease accounting. As building construction began in the fourth quarter of

2013, we recorded estimated project construction costs incurred by the landlord as an asset and a corresponding

long term liability in “Property and equipment, net” and “Other long-term liabilities,” respectively, on our

consolidated balance sheets. We will increase the asset and corresponding long term liability as additional

building costs are incurred by the landlord during the construction period.

101