TripAdvisor 2013 Annual Report Download - page 22

Download and view the complete annual report

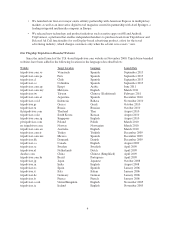

Please find page 22 of the 2013 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.20% of desktop monetization of hotel shoppers during the year ended December 31, 2013, while tablets monetize

more closely to desktops.

Competition

We face competition for users, advertisers and travel reviews. Our primary competitors include large online

portals, social networking sites and search engines, such as Google, Microsoft’s Bing (including Bing Travel),

Yahoo! (including Yahoo! Travel) and Baidu. We face competition from online travel agencies (such as Expedia

and Priceline and their respective subsidiaries), as well as wholesalers, tour operators and traditional offline

travel agencies. We also compete with a wide range of other companies, including Airbnb, Inc., Ctrip.com

International, Ltd., HolidayCheck AG, HomeAway, Inc., and Yelp, Inc.

Competition for Content and Travel Reviews

We are the world’s largest global platform for travel-related reviews and opinions and we face competition

in the travel review space from online travel agencies, such as Expedia and Priceline and their respective

subsidiaries, which solicit reviews from travelers who book travel on their websites. Moreover, networks with

significant installed user bases such as Google (for example, via Google + Local and Google Hotel Finder) have

begun to compete more directly with us by attracting and accumulating user-generated travel reviews and

opinions or may pursue the acquisition of travel-related content directly from consumers, and other networks and

channels, like Facebook, could choose to do the same.

Competition for Users

In the competition to attract users, we rely on our ability to acquire traffic through offline brand recognition

and brand-direct efforts such as television, email and online search, whether unpaid or paid. Unpaid search is

sometimes referred to as search engine optimization, or SEO, which is the practice of developing websites with

relevant and current content that rank well in “organic,” or unpaid, search engine results. SEO can be affected by

a number of factors including competitive site content, changes to our website architecture and page designs,

changes to search engine ranking algorithms, or changes to display ordering in search engine results such as

preferred placement for internal products offered by search engines. SEM is a form of Internet marketing that

involves the promotion of websites by increasing their visibility in search engine results pages through the use of

paid placement, contextual advertising, and paid inclusion. SEM is a competitive marketplace with competitors

continually updating their traffic acquisition strategies and economic models across a large number of keywords

and markets.

Competition for Advertisers

We compete for travel-related advertising budgets with large, established search engines with significantly

greater resources than we have, such as Google, Bing, and Yahoo!, as well as online media companies and ad

networks, offline advertising sources, such as television and print media. These competitors have large client

bases and significantly greater resources than we have and expertise in developing online commerce and

facilitating internet traffic are creating inroads into online travel. Competition from these parties could cause us

to lose advertising customers or shares of advertising expenditures. For example, Google has launched “Hotel

Finder”, a search tool that enables users to search and compare hotel accommodations based on parameters set by

users and has, at times, placed the Google supplier websites or its own search engine at or near the top of hotel-

related search results. In addition, Microsoft has launched Bing Travel, which searches for hotel reservations and

air fares online and predicts the best time to purchase them. If Google, Bing or any other leading search engines

refer significant traffic to these or other travel services that they develop in the future, or otherwise favor supplier

websites or other travel service websites over other online travel sites, including us, it would likely become more

difficult and expensive for us to generate traffic to our websites and therefore maintain or grow our market share.

12