TripAdvisor 2013 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2013 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

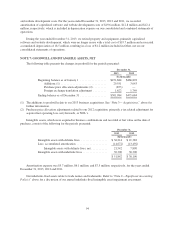

Diluted Earnings Per Share

We compute diluted earnings per share by dividing net income attributable to TripAdvisor by the sum of the

weighted average number of common and common equivalent shares outstanding during the period. We

computed the weighted average number of common and common equivalent shares outstanding during the period

using the sum of (i) the number of shares of common stock and Class B common stock used in the basic earnings

per share calculation as indicated above, and (ii) if dilutive, the incremental weighted average common stock that

we would issue upon the assumed exercise of outstanding common equivalent shares related to stock options,

stock warrants and the vesting of restricted stock units using the treasury stock method, and (iii) if dilutive,

performance based awards based on the number of shares that would be issuable as of the end of the reporting

period assuming the end of the reporting period was also the end of the contingency period.

We treated all outstanding equity awards assumed at Spin-Off as if they were granted as of the Spin-Off and

we included them in our diluted earnings per share calculation for the year ended December 31, 2011, based on

the number of days they were outstanding.

Under the treasury stock method, the assumed proceeds calculation includes the actual proceeds to be

received from the employee upon exercise, the average unrecognized compensation cost during the period and

any tax benefits credited upon exercise to additional paid-in-capital. The treasury stock method assumes that a

company uses the proceeds from the exercise of an award to repurchase common stock at the average market

price for the period. Windfall tax benefits created upon the exercise of an award would be added to assumed

proceeds, while shortfalls charged to additional paid-in-capital would be deducted from assumed proceeds. Any

shortfalls not covered by the windfall tax pool would be charged to the income statement and would be excluded

from the calculation of assumed proceeds, if any.

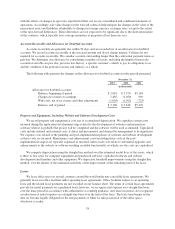

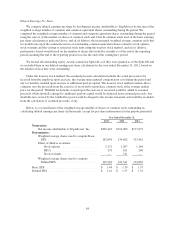

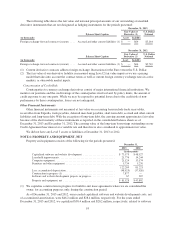

Below is a reconciliation of the weighted average number of shares of common stock outstanding in

calculating diluted earnings per share (in thousands, except for per share information) for the periods presented:

Year Ended December 31,

2013 2012 2011

Numerator:

Net income attributable to TripAdvisor, Inc. .... $205,443 $194,069 $177,677

Denominator:

Weighted average shares used to compute Basic

EPS .................................. 142,854 139,462 133,461

Effect of dilutive securities:

Stock options ........................ 2,131 1,207 1,164

RSUs ............................... 278 161 240

Stock warrants ....................... — 511 —

Weighted average shares used to compute

Diluted EPS ........................... 145,263 141,341 134,865

Basic EPS ................................... $ 1.44 $ 1.39 $ 1.33

Diluted EPS ................................. $ 1.41 $ 1.37 $ 1.32

84