TripAdvisor 2013 Annual Report Download - page 63

Download and view the complete annual report

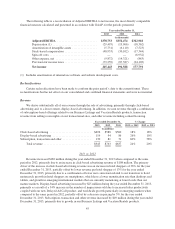

Please find page 63 of the 2013 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.future. Amounts assume that our existing debt is repaid at maturity and do not assume additional borrowings

or refinancings of existing debt. See “Note 8—Debt” in the notes to the consolidated and combined financial

statements for additional information on our Term Loan and Chinese Credit Facilities.

(2) Estimated future minimum rental payments for our future corporate headquarters in Needham, MA. See

discussion under “Office Lease Commitments” below.

(3) Excludes amounts already recorded on the consolidated balance sheet at December 31, 2013.

(4) Excluded from the table was $38 million of unrecognized tax benefits, including interest and penalties, that

we have recorded in other long-term liabilities for which we cannot make a reasonably reliable estimate of

the amount and period of payment. We estimate that none of these amounts will be paid within the next

twelve months.

(5) In connection with the Spin-Off, we assumed Expedia’s obligation to fund a charitable foundation. The

Board of Directors of the charitable foundation is currently comprised of Stephen Kaufer- President and

Chief Executive Officer, Julie M.B. Bradley-Chief Financial Officer and Seth J. Kalvert- Senior Vice

President, General Counsel and Secretary. Our obligation was calculated at 2.0% of OIBA in 2013. For a

discussion regarding OIBA see “Note 16—Segment Information” in the notes to the consolidated and

combined financial statements. This future commitment has been excluded from the table above.

(6) Excludes spending on anticipated leasehold improvements on our Needham, Massachusetts lease, including

design, development, construction costs, and the purchase and installation of equipment, net of related

Landlord incentives, which we estimate will begin in the fourth quarter of 2014 thru the second quarter of

2015 and currently estimate will cost in the range of $35-$40 million.

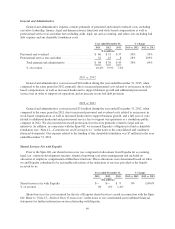

Term Loan Facility Due 2016 and Revolving Credit Facility

On December 20, 2011, in connection with the Spin-Off, we entered into the Credit Agreement, which

provides $600 million of borrowing including:

• the Term Loan Facility, or Term Loan, in an aggregate principal amount of $400 million with a term of

five years due December 2016; and

• the Revolving Credit Facility in an aggregate principal amount of $200 million available in U.S.

dollars, Euros and British pound sterling with a term of five years expiring December 2016.

The Term Loan and any loans under the Revolving Credit Facility bear interest by reference to a base rate or

a Eurocurrency rate, in either case plus an applicable margin based on our leverage ratio. We are also required to

pay a quarterly commitment fee, on the average daily unused portion of the Revolving Credit Facility for each

fiscal quarter and fees in connection with the issuance of letters of credit. The Term Loan and loans under the

Revolving Credit Facility currently bear interest at LIBOR plus 150 basis points, or the Eurocurrency Spread, or

the alternate base rate (“ABR”) plus 50 basis points, and undrawn amounts are currently subject to a commitment

fee of 22.5 basis points.

As of December 31, 2013 we are using a one-month interest period Eurocurrency Spread which is

approximately 1.7% per annum. Interest is currently payable on a monthly basis while we are borrowing under

the one-month interest rate period. The current interest rates are based on current assumptions, leverage and

LIBOR rates and do not take into account that rates will reset periodically. A 25 basis point change in the interest

rate on the current Term Loan balance would result in an increase or decrease to interest expense of

approximately $0.9 million per annum.

The Revolving Credit Facility includes $40 million of borrowing capacity available for letters of credit and

$40 million for borrowings on same-day notice. As of December 31, 2013 there are no outstanding borrowings

under our Revolving Credit Facility.

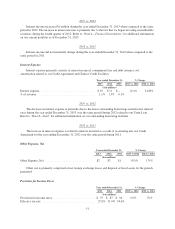

Prepayments

We may voluntarily repay any outstanding borrowing under the Credit Agreement at any time without

premium or penalty, other than customary breakage costs with respect to Eurocurrency loans.

53