TripAdvisor 2013 Annual Report Download - page 114

Download and view the complete annual report

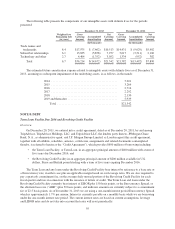

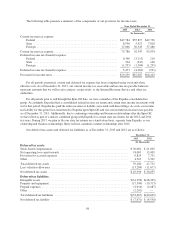

Please find page 114 of the 2013 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Plan on an after-tax basis up to an annual maximum of 10%. The 401(k) Plan has an automatic enrollment

feature at 3% pre-tax. We match 50% of the first 6% of employee contributions to the plan for a maximum

employer contribution of 3% of a participant’s eligible earnings. The “catch up contributions”, are not eligible for

employer matching contributions. The matching contributions portion of an employee’s account, vests after two

years of service. Effective June 8, 2012 the 401(k) Plan permits certain after-tax Roth 401(k) contributions.

Additionally, at the end of the 401 (k) Plan year, we make a discretionary matching contribution to eligible

participants. This additional discretionary matching employer contribution referred to as “true up” is limited to

match only contributions up to 3% of eligible compensation.

Our employee’s interests were rolled into the 401(k) Plan from the Expedia 401(k) Plan in connection with

the creation of our new plan on November 1, 2011. We also have various defined contribution plans for our

international employees. Our contribution to the 401(k) Plan and our international defined contribution plans was

not material for the period from November 1, 2011 through December 31, 2011 and $4.8 million and $3.1

million for the years ended December 31, 2013 and 2012, respectively.

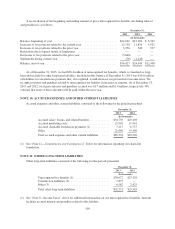

TripAdvisor, Inc. Deferred Compensation Plan for Non-Employee Directors

On December 20, 2011, the TripAdvisor, Inc. Deferred Compensation Plan for Non-Employee Directors

(the “Plan”) became effective. Under the Plan, eligible directors who defer their directors’ fees may elect to have

such deferred fees (i) applied to the purchase of share units, representing the number of shares of our common

stock that could have been purchased on the date such fees would otherwise be payable, or (ii) credited to a cash

fund. The cash fund will be credited with interest at an annual rate equal to the weighted average prime or base

lending rate of a financial institution selected in accordance with the terms of the Plan and applicable law. Upon

termination of service as a director of TripAdvisor, a director will receive (i) with respect to share units, such

number of shares of our common stock as the share units represent, and (ii) with respect to the cash fund, a cash

payment. Payments upon termination will be made in either one lump sum or up to five annual installments, as

elected by the eligible director at the time of the deferral election.

Under the 2011 Incentive Plan, 100,000 shares of TripAdvisor common stock are available for issuance to

non-employee directors. There have been no shares of common stock issued from the inception of the Plan

through December 31, 2013.

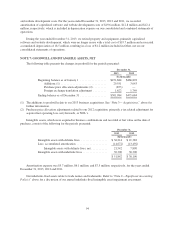

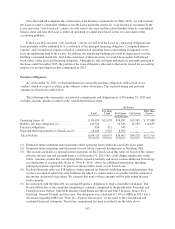

NOTE 14: STOCKHOLDERS’ EQUITY

Preferred Stock

In addition to common stock, we are authorized to issue up to 100 million preferred shares, with $ 0.001 par

value per share, with terms determined by our Board of Directors, without further action by our stockholders. At

December 31, 2013, no preferred shares had been issued.

Common Stock and Class B Common Stock

Our authorized common stock consists of 1.6 billion shares of common stock with par value of $0.001 per

share, and 400 million shares of Class B common stock with par value of $0.001 per share. Both classes of

common stock qualify for and share equally in dividends, if declared by our Board of Directors. Common stock

is entitled to one vote per share and Class B common stock is entitled to 10 votes per share on most matters.

Holders of TripAdvisor common stock, acting as a single class, are entitled to elect a number of directors equal

to 25% percent of the total number of directors, rounded up to the next whole number, which was three directors

as of December 31, 2013. Class B common stockholders may, at any time, convert their shares into common

stock, on a one for one share basis. Upon conversion, the Class B common stock is retired and is not available for

reissue. In the event of liquidation, dissolution, distribution of assets or winding-up of TripAdvisor the holders of

both classes of common stock have equal rights to receive all the assets of TripAdvisor after the rights of the

holders of the preferred stock have been satisfied. There were 131,537,798 and 129,417,089 shares of common

104