TripAdvisor 2013 Annual Report Download - page 50

Download and view the complete annual report

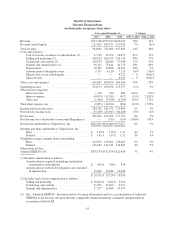

Please find page 50 of the 2013 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.property, allowing the user to shop for the best price. Pricing is the effective CPC that online travel

agencies and hoteliers are willing to pay us for a hotel shopper lead. Revenue per hotel shopper

decreased 13% for the year ended December 31, 2013 in comparison to 2012, and decreased 8% for the

year ended December 31, 2012 in comparison to 2011, according to our log files.

In summary, our CPC revenue depends on the number of hotel shoppers that are interested in a property,

whether there is a commerce link available for that hotel shopper to click on for that property, whether there are

several commerce choices available for that property so the hotel shopper has the benefit of pricing and

availability from multiple sources and what our customers are willing to pay us for the lead.

Key Drivers of Display-Based Advertising Revenue

For the years ended December 31, 2013, 2012 and 2011, 13%, 12% and 13%, respectively, of our total

revenue came from our display-based advertising product. The key drivers of our display-based advertising

revenue include the growth in number of impressions, or the number of times an ad is displayed on our site, and

the cost per thousand impressions, or CPM. Our number of impressions sold increased 34% for the year ended

December 31, 2013 over 2012 and increased 6% for the year ended December 31, 2012 over 2011, while pricing

decreased 5% for the year ended December 31, 2013 over 2012 and increased 1% for the years ended

December 31, 2012 over 2011, according to our customer logs.

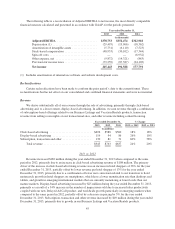

Key Growth Areas

We continue to invest in areas of potential growth, including our social, mobile and global initiatives as well

as our Business Listings and Vacation Rentals products.

Mobile. Mobile is an investment area that is geared towards creating a more complete user experience by

reinforcing the TripAdvisor brand when users are in-market. In the year ended December 31, 2013, we saw

strong mobile user uptake, as aggregate downloads of our TripAdvisor, City Guides, SeatGuru, Jetsetter and

GateGuru mobile apps reached 82 million downloads and average monthly unique visitors via smartphone and

tablet devices grew over 170% year-over-year from 32 million to 87 million, according to company logs. We

believe that travelers will increasingly use mobile devices, including smartphones and tablets, to conduct travel

research and planning.

Social. Our Wisdom of Friends initiative is a core component of our strategic growth plan. We believe that

having a strong social presence improves engagement on our sites and improves the sites’ “stickiness” amongst

the users. As a result, we continue to deepen our integration with Facebook. As of December 31, 2013, and

according to AppData, an independent application tracking traffic service, TripAdvisor has averaged over

36 million monthly Facebook users via its TripAdvisor Facebook application. We offer these Facebook users a

more personalized and social travel planning experience that enables travelers to engage with their own Facebook

friends’ reviews and opinions when planning their perfect trip on TripAdvisor.

Business Listings. Created in early 2010, our Business Listings product enables hotel and accommodation

owners to list pertinent property information on TripAdvisor, bringing them closer to potential customers and

thereby increasing direct bookings. In the year ended December 31, 2013, we grew our Business Listings

customer base over 38% to 69,000 subscribers, representing approximately 9% of our current hotel and

accommodation listings on TripAdvisor branded sites. We continue to expand our sales force and improve

features to grow our subscriber base.

Vacation Rentals. As of December 31, 2013, we had amassed an inventory of approximately 550,000

properties, up more than 80% during the year, across our TripAdvisor Vacation Rentals, U.S.-based FlipKey, and

European-based Holiday Lettings and Niumba. We offer individual property owners and property managers the

ability to list using a subscription-based fee structure or a free-to-list, commission-based option and we believe

our highly-engaged and motivated user community creates a competitive advantage for us in this market.

40