TripAdvisor 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In June 2013, TripAdvisor LLC (“TA LLC”), our indirect, wholly owned subsidiary, entered into a lease

(the “Lease”), for a new corporate headquarters. Pursuant to the Lease, the landlord will build an approximately

280,000 square foot rental building in Needham, Massachusetts (the “Premises”), and thereafter lease the

Premises to TA LLC as TripAdvisor’s new corporate headquarters for an initial term of 15 years and 7 months. If

the landlord fails to deliver the Premises according to the schedule, subject to certain conditions, TA LLC may be

entitled to additional free rent, or in extreme cases, a right to terminate the Lease. Under the Lease, TA LLC is

required to pay an initial base rent of $33.00 per square foot per year, increasing to $34.50 per square foot by the

final year of the initial term, as well as all real estate taxes and other building operating costs. TA LLC also has

an option to extend the term of the Lease for two consecutive terms of five years each.

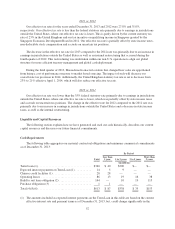

The aggregate future minimum lease payments are $143.5 million and are currently scheduled to be paid,

beginning in November 2015, as follows: $1.1 million for 2015, $9.3 million for 2016, $9.3 million for 2017,

$9.3 million for 2018 and $114.6 million for 2019 and thereafter. The Lease has escalating rental payments and

initial periods of free rent. TA LLC was also obligated to deliver a letter of credit to the Landlord in the amount

of $0.8 million as security deposit, which amount is subject to increase under certain circumstances. TA LLC

also has an option to extend the term of the Lease for two consecutive terms of five years each. In connection

with the Lease, TripAdvisor entered into a Guaranty (the “Guaranty”), pursuant to which TripAdvisor provides

full payment and performance guaranty for all of TA LLC’s obligations under the Lease.

We have concluded we are the deemed owner (for accounting purposes only) of the Premises during the

construction period under GAAP build to suit lease accounting. As building construction began in the fourth

quarter of 2013, we recorded estimated project construction costs incurred by the landlord as an asset and a

corresponding long term liability in “Property and equipment, net” and “Other long-term liabilities,”

respectively, on our consolidated balance sheets. We will increase the asset and corresponding long term liability

as additional building costs are incurred by the landlord during the construction period.

Once the landlord completes the construction of the Premises (estimated to be May 2015), we will evaluate

the Lease in order to determine whether or not the Lease meets the criteria for “sale-leaseback” treatment. If the

Lease meets the “sale-leaseback” criteria, we will remove the asset and the related liability from its consolidated

balance sheet and treat the Lease as either an operating or capital lease based on the our assessment of the

accounting guidance.

If the Lease does not meet “sale-leaseback” criteria, we will treat the Lease as a financing obligation and

lease payments will be attributed to (1) a reduction of the principal financing obligation; (2) imputed interest

expense; and (3) land lease expense (which is considered an operating lease) representing an imputed cost to

lease the underlying land of the facility. In addition, the underlying building asset will be depreciated over the

building’s estimated useful life. And at the conclusion of the lease term, we would de-recognize both the net

book values of the asset and financing obligation. Although we will not begin making lease payments pursuant to

the Lease until November 2015, the portion of the lease obligations allocated to the land is treated for accounting

purposes as an operating lease that commenced in 2013.

Purchase Obligations

These amounts represent minimum non-cancelable purchase obligations with certain of our vendors, which

we expect to utilize in the ordinary course of business.

Letters of Credit

As of December 31, 2013, we have issued unused letters of credit totaling $1 million, related to our property

leases.

55