TripAdvisor 2013 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2013 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

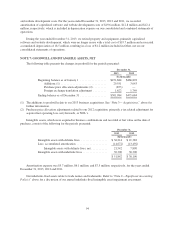

At December 31, 2013, we had federal, state and foreign net operating loss carryforwards (“NOLs”) of

approximately $ 12.5 million, $12.4 million and $51.0 million. If not utilized, the federal and state NOLs will

expire at various times between 2020 and 2033 and the foreign NOLs will expire at various times between 2013

and 2031.

At December 31, 2013, we had a valuation allowance of $13.3 million primarily related to foreign net

operating loss carryforwards for which it is more likely than not that the tax benefit will not be realized. This

amount represented an overall increase of $1.6 million over the amount recorded as of December 31, 2012.

We have not provided for deferred U.S. income taxes on undistributed earnings of our foreign subsidiaries

that we intend to reinvest permanently outside the United States; the total amount of such earnings as of

December 31, 2013 was $481.0 million. Should we distribute or be treated under certain U.S. tax rules as having

distributed earnings of foreign subsidiaries in the form of dividends or otherwise, we may be subject to

U.S. income taxes. Due to complexities in tax laws and various assumptions that would have to be made, it is not

practicable at this time to estimate the amount of unrecognized deferred U.S. taxes on these earnings.

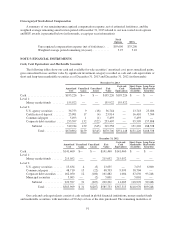

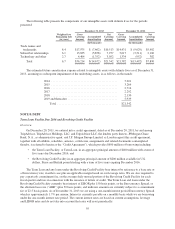

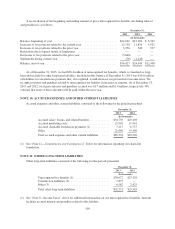

A reconciliation of the provision for income taxes to the amounts computed by applying the statutory

federal income tax rate to income before income taxes is as follows:

Year Ended December 31,

2013 2012 2011

(In thousands)

Income tax expense at the federal statutory rate of 35% ................... $99,646 $ 98,691 $ 95,163

Foreign rate differential ............................................ (41,487) (25,069) (15,319)

State income taxes, net of effect of federal tax benefit .................... 8,339 5,581 4,240

Unrecognized tax benefits and related interest .......................... 9,307 4,853 2,570

Non-deductible transaction costs ..................................... 253 — 2,426

Change in valuation allowance ...................................... 1,999 2,535 3,451

Other, net ....................................................... 1,202 796 1,572

Provision for income taxes .......................................... $79,259 $ 87,387 $ 94,103

During the fourth quarter of 2012, we restructured our non-U.S. operations to align our global structure for

more efficient treasury management and global cash deployment. As a result, and due to the continued expansion

of our non-U.S. operations, we expect our effective tax rate to continue to decrease.

During 2011, the Singapore Economic Development Board accepted our application to receive a tax

incentive under the International Headquarters Award. This incentive provides for a reduced tax rate on

qualifying income of 5% as compared to Singapore’s statutory tax rate of 17% and is conditional upon our

meeting certain employment and investment thresholds. This agreement is set to expire on June 30, 2016, with

the ability to extend for another five years. This benefit resulted in a decrease to the 2013 tax provision of $4.3

million.

By virtue of previously filed consolidated income tax returns filed with Expedia, we are routinely under

audit by federal, state and foreign tax authorities. We are currently under an IRS audit for the 2009 and 2010 tax

years, and have various ongoing state income tax audits. As of December 31, 2013, no material assessments have

resulted from these audits. These audits include questioning the timing and the amount of income and deductions

and the allocation of income among various tax jurisdictions. Annual tax provisions include amounts considered

sufficient to pay assessments that may result from the examination of prior year returns. We are no longer subject

to tax examinations by tax authorities for years prior to 2007.

99