TripAdvisor 2013 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2013 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

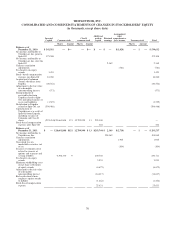

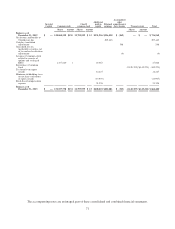

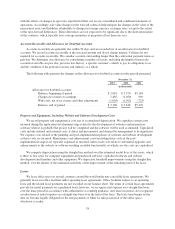

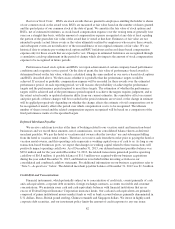

TRIPADVISOR, INC.

CONSOLIDATED AND COMBINED STATEMENTS OF CASH FLOWS

(in thousands)

Year Ended December 31,

2013 2012 2011

Operating activities:

Net income ................................................................................... $205,443 $ 194,588 $ 177,791

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation of property and equipment, including amortization of internal-use software and website

development ............................................................................ 29,495 19,966 18,362

Stock-based compensation ................................................................... 48,953 30,102 17,344

Amortization of intangible assets .............................................................. 5,731 6,110 7,523

Amortization of deferred financing costs ........................................................ 779 889 21

Amortization of discounts and premiums on marketable securities, net ................................ 4,905 527 —

Deferred tax (benefit) expense ................................................................ 5,473 (4,960) (931)

Excess tax benefits from stock-based compensation ............................................... (12,425) (2,717) (1,571)

Provision (recovery) for doubtful accounts ...................................................... 1,485 (1,050) 909

Foreign currency transaction (gains) losses, net .................................................. (154) 1,644 209

Other, net ................................................................................ 1,691 187 (131)

Changes in operating assets and liabilities, net of effects from acquisitions:

Accounts receivable .................................................................... (16,184) (11,810) (15,910)

Receivable from Expedia,net ............................................................. 8,099 (16,921) —

Taxes receivable ....................................................................... 9,952 (24,243) —

Prepaid expenses and other assets ......................................................... (3,655) (3,305) (1,821)

Accounts payable ...................................................................... (5,884) 15,322 4,133

Deferred merchant payable .............................................................. 16,767 (1,345) 1,752

Taxes payable ......................................................................... 16,852 7,073 3,244

Accrued expenses and other liabilities ...................................................... 23,404 17,067 82

Deferred revenue ...................................................................... 8,796 11,942 6,876

Net cash provided by operating activities ......................................................... 349,523 239,066 217,882

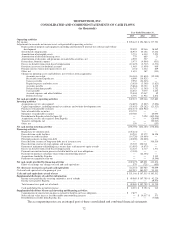

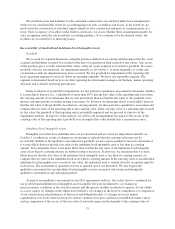

Investing activities:

Acquisitions, net of cash acquired ............................................................. (34,819) (3,007) (7,894)

Capital expenditures, including internal-use software and website development costs .................... (55,455) (29,282) (21,323)

Purchases of marketable securities ............................................................ (432,373) (218,922) —

Sales of marketable securities ................................................................ 174,723 — —

Maturities of marketable securities ............................................................ 150,780 — 20,090

Distribution to Expedia related to Spin-Off ...................................................... — 7,028 (405,516)

Acquisitions, net of cash acquired, from Expedia ................................................. — — (28,099)

Transfers to Expedia, net .................................................................... — — (95,967)

Other, net ................................................................................ 350 — (153)

Net cash used in investing activities .............................................................. (196,794) (244,183) (538,862)

Financing activities:

Repurchase of common stock ................................................................ (145,221) — —

Proceeds from credit facilities ................................................................ 10,201 15,372 18,158

Payments on credit facilities ................................................................. (14,728) (10,000) —

Principal payments on long-term debt .......................................................... (40,000) (20,000) —

Proceeds from issuance of long-term debt, net of issuance costs ..................................... — — 396,516

Proceeds from exercise of stock options and warrants ............................................. 23,703 230,711 —

Payment of minimum withholding taxes on net share settlements of equity awards ...................... (13,907) (6,675) —

Excess tax benefits from stock-based compensation ............................................... 12,425 2,717 1,571

Payments on construction in process related to build to suit lease obligations ........................... (2,148) — —

Payments to purchase subsidiary shares from noncontrolling interest ................................. — (22,304) —

Acquisitions funded by Expedia .............................................................. — — 5,135

Payments on acquisition earn-out ............................................................. — — (9,546)

Net cash (used) provided by financing activities .................................................... (169,675) 189,821 411,834

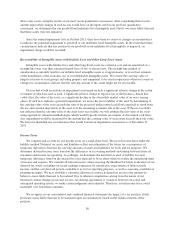

Effect of exchange rate changes on cash and cash equivalents ....................................... 579 (721) (455)

Net (decrease) increase in cash and cash equivalents ................................................ (16,367) 183,983 90,399

Cash and cash equivalents at beginning of year ...................................................... 367,515 183,532 93,133

Cash and cash equivalents at end of year ......................................................... $351,148 $ 367,515 $ 183,532

Supplemental disclosure of cash flow information:

Income taxes paid directly to taxing authorities, net of refunds ...................................... $ 49,989 $ 107,799 $ 42,220

Income taxes paid to Expedia ................................................................ — — 49,570

Total income taxes paid, net of refunds ......................................................... $ 49,989 $ 107,799 $ 91,790

Cash paid during the period for interest ......................................................... $ 8,291 $ 9,792 $ 313

Supplemental disclosure of non-cash investing and financing activities:

Capitalization of construction in-process related to build to suit lease obligation ......................... $ 7,877 — —

Non-cash fair value increase for redeemable noncontrolling interests ................................. — $ 14,617 $ 571

Distribution receivable from Expedia, Inc. ...................................................... — — (7,028)

The accompanying notes are an integral part of these consolidated and combined financial statements.

72