TripAdvisor 2013 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2013 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

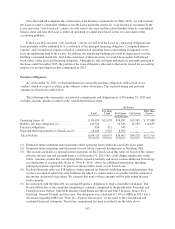

The Term Loan principal is currently repayable in quarterly installments on the last day of each calendar

quarter equal to 2.5% of the original principal amount with the balance due on the final maturity date. Principal

payments aggregating $40 million were made during the year ended December 31, 2013.

The Revolving Credit Facility includes $40 million of borrowing capacity available for letters of credit and

$40 million for borrowings on same-day notice. As of December 31, 2013 there are no outstanding borrowings

under our Revolving Credit Facility.

During the years ended December 31, 2013, 2012 and 2011, we recorded total interest and commitment fees

on our Credit Agreement of $7.5 million, $8.7 million and $0.3 million, respectively, to interest expense on our

consolidated and combined statements of operations. All unpaid interest and commitment fee amounts as of

December 31, 2013 and 2012 were not material.

In connection with the Credit Agreement, we also incurred debt financing costs totaling $3.5 million, which

were capitalized as deferred financing costs. Approximately $0.7 million, recorded in other current assets, and

approximately $ 1.1 million, reported in other long term assets, remain on the consolidated balance sheet as of

December 31, 2013, net of amortization. During the years ended December 31, 2013, 2012 and 2011, we

recorded amortization expense of $0.8 million, $0.9 million and $0 million, respectively, to interest expense on

our consolidated and consolidated statements of operations. These costs will continue to be amortized over the

remaining term of the Term Loan using the effective interest rate method.

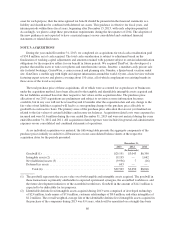

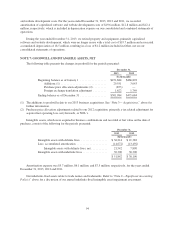

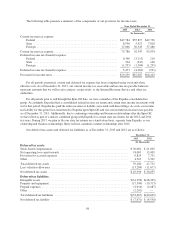

Total outstanding borrowings under the Credit Agreement consist of the following:

December 31,

2013

(in thousands)

Short-Term Debt:

Revolving Credit Facility ...................... $ —

Term Loan ................................. 40,000

Total Short-Term Borrowings ...................... $ 40,000

Long-Term Debt:

Term Loan ................................. $300,000

Total Long-Term Borrowings ...................... $300,000

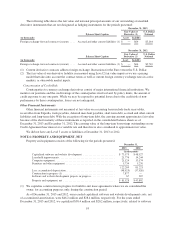

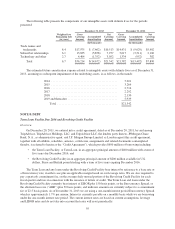

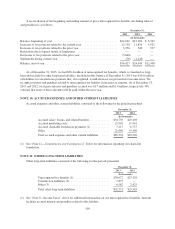

The future minimum principal payment obligations due under the Credit Agreement related to our Term

Loan is as follows:

Year Ending December 31,

Principal Payments

(in thousands)

2014 .................................. $ 40,000

2015 .................................. 40,000

2016 .................................. 260,000

Total ...................................... $340,000

Prepayments

We may voluntarily repay any outstanding borrowing under the Credit Agreement at any time without

premium or penalty, other than customary breakage costs with respect to eurocurrency loans.

Guarantees

All obligations under the Credit Agreement are unconditionally guaranteed by us and each of our existing

and subsequently acquired or organized direct or indirect wholly-owned domestic and foreign restricted

96