TripAdvisor 2013 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2013 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

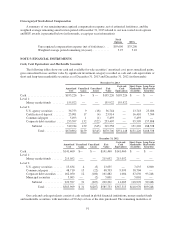

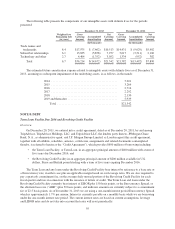

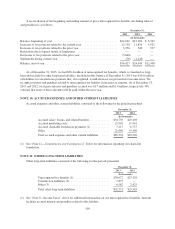

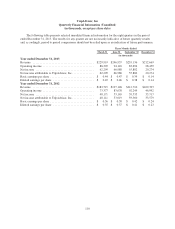

A reconciliation of the beginning and ending amount of gross unrecognized tax benefits (excluding interest

and penalties) is as follows:

December 31,

2013 2012 2011

(In thousands)

Balance, beginning of year ............................................ $24,049 $12,900 $ 6,342

Increases to tax positions related to the current year ........................ 12,158 11,854 5,631

Increases to tax positions related to the prior year .......................... 3,936 540 927

Reductions due to lapsed statute of limitations ............................ — — —

Decreases to tax positions related to the prior year ......................... (3,640) — —

Settlements during current year ........................................ (76) (1,245) —

Balance, end of year ................................................. $36,427 $24,049 $12,900

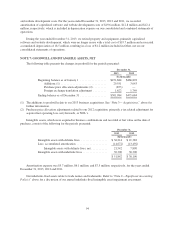

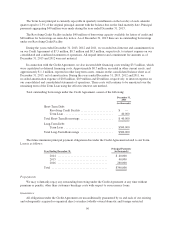

As of December 31, 2013, we had $36.4 million of unrecognized tax benefits, which is classified as long-

term and included in other long-term liabilities. Included in this balance at December 31, 2013 was $19.0 million

of liabilities for uncertain tax positions that, if recognized, would decrease our provision for income taxes. We

recognize interest and penalties related to unrecognized tax benefits in income tax expense. As of December 31,

2013 and 2012, total gross interest and penalties accrued was $1.7 million and $1.0 million, respectively. We

estimate that none of these amounts will be paid within the next year.

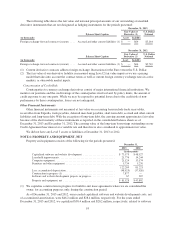

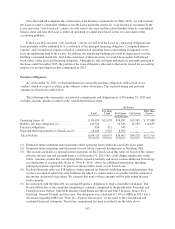

NOTE 10: ACCRUED EXPENSES AND OTHER CURRENT LIABILITIES

Accrued expenses and other current liabilities consisted of the following for the periods presented:

December 31,

2013 2012

(In thousands)

Accrued salary, bonus, and related benefits ............. $34,756 $29,438

Accrued marketing costs ............................ 21,901 11,941

Accrued charitable foundation payments (1) ............ 7,217 6,757

Other ........................................... 21,660 15,100

Total accrued expenses and other current liabilities ....... $85,534 $63,236

(1) See “Note 12—Commitments and Contingencies” below for information regarding our charitable

foundation.

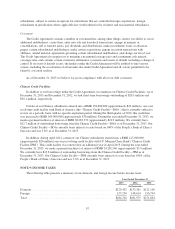

NOTE 11: OTHER LONG-TERM LIABILITIES

Other long-term liabilities consisted of the following for the periods presented:

December 31,

2013 2012

(In thousands)

Unrecognized tax benefits (1) ........................ $38,072 $23,138

Construction liabilities (2) ........................... 7,877 —

Other (3) ........................................ 6,582 2,425

Total other long-term liabilities ...................... $52,531 $25,563

(1) See “Note 9—Income Taxes” above for additional information on our unrecognized tax benefits. Amount

includes accrued interest and penalties related to this liability.

100