TripAdvisor 2013 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2013 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Treasury Stock

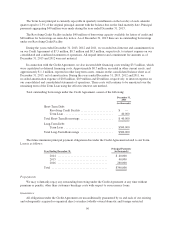

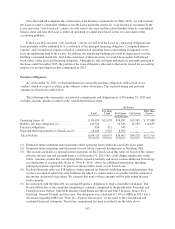

On February 15, 2013, our Board of Directors authorized the repurchase of $250 million of our shares of

common stock under a share repurchase program. We intend to use available cash and future cash from

operations to fund repurchases under the share repurchase program. The repurchase program has no expiration

date but may be suspended or terminated by the Board of Directors at any time. Our Board of Directors will

determine the price, timing, amount and method of such repurchases based on its evaluation of market conditions

and other factors, and any shares repurchased will be in compliance with applicable legal requirements, at prices

determined to be attractive and in the best interests of both the Company and its stockholders.

During the year ended December 31, 2013, we repurchased 2,120,709 shares of outstanding common stock

under the share repurchase program at an aggregate cost of $145.2 million. As of December 31, 2013, from the

authorized share repurchase program granted by the Board of Directors we have $104.8 million remaining to

repurchase shares of our common stock.

Dividends

During the period January 1, 2013 through December 31, 2013, our Board of Directors did not declare any

dividends on our outstanding common stock and do not expect to pay any dividends for the foreseeable future.

NOTE 15: RELATED PARTY TRANSACTIONS

Relationship between Expedia and TripAdvisor

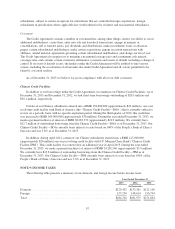

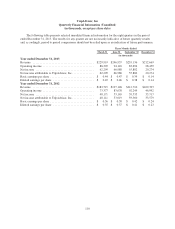

Upon consummation of the Spin-Off, Expedia was considered a related party under GAAP based on a

number of factors, including, among others, common ownership of our shares and those of Expedia. A number of

those factors no longer exist; as a result, we no longer consider Expedia a related party; however, due to the

importance of our relationship with Expedia, for purposes of these financial statements for the year ended

December 31, 2013, we have continued to list separately in our consolidated and combined financial statements

revenue and receivables from Expedia.

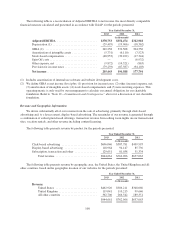

Revenue from Expedia was $217.4 million, 203.8 million and $211.0 million for the years ended

December 31, 2013, 2012 and 2011, respectively, which primarily consists of click-based advertising and other

advertising services provided to Expedia and its subsidiaries and is recorded at contract value, which we believe

is a reasonable reflection of the value of the services provided. Revenue represented 23%, 27% and 33% of our

total revenue for the years ended December 31, 2013, 2012 and 2011, respectively. Other operating expenses

which were included primarily within selling and marketing expense were $6.0 million, $6.4 million, and $4.3

million for the years ended December 31, 2013, 2012 and 2011, respectively, primarily consisted of marketing

expense for exit windows. The receivable balances with Expedia reflected in our consolidated balance sheets as

of December 31, 2013 and December 31, 2012 were $15.8 million and $24.0 million, respectively.

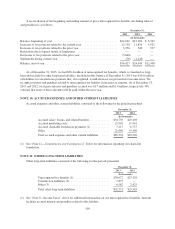

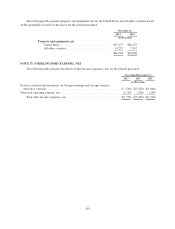

Prior to the Spin-Off, our operating expenses included a shared services fee, which was $9.2 million for the

year ended December 31, 2011, which was comprised of allocations from Expedia for accounting, legal, tax,

corporate development, financial reporting, treasury and real estate functions and included an allocation of

employee compensation within these functions. These allocations were determined on a basis that Expedia and

we considered to be a reasonable reflection of the cost of services provided or the benefit received by us. These

expenses were allocated based on a number of factors including headcount, estimated time spent and operating

expenses. It was not practicable to determine the amounts of these expenses that would have been incurred had

we operated as an unaffiliated entity. In the opinion of our management, the allocation method was reasonable.

We transferred $405.5 million in cash to Expedia in the form of a dividend, prior to completion of the Spin-

Off. Per the Separation Agreement we were to retain $165 million in cash on hand immediately following the

Spin-off and the agreement also provided for a subsequent reconciliation process to ensure the appropriate

amount was retained. The completion of this reconciliation resulted in us recording an additional receivable from

Expedia of $7 million at December 31, 2011, which was subsequently received by us during 2012.

106