TripAdvisor 2013 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2013 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

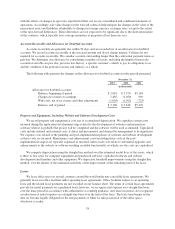

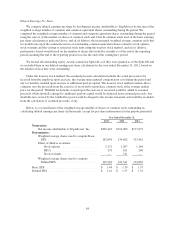

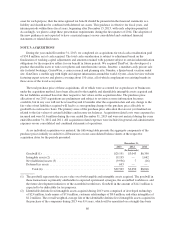

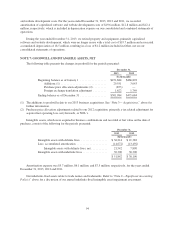

The following potential common shares related to stock options, stock warrants and RSUs were excluded

from the calculation of diluted net income per share because their effect would have been anti-dilutive for the

periods presented:

December 31,

2013 (1) 2012 (2)(3) 2011 (3)

(In thousands)

Stock options .................................... 2,244 3,944 2,261

RSUs .......................................... 27 21 80

Warrants ........................................ — — 8,047

Total ........................................... 2,271 3,965 10,388

(1) These totals do not include 155,000 performance based options and 44,000 performance based RSUs

representing the right to acquire 199,000 shares of common stock for which all targets required to trigger

vesting have not been achieved; therefore, such awards were excluded from the calculation of weighted

average shares used to compute diluted earnings per share for those reporting periods.

(2) These totals do not include performance based options representing the right to acquire 110,000 shares of

common stock, respectively, for which all targets required to trigger vesting had not been achieved;

therefore, such awards were excluded from the calculation of weighted average shares used to compute

diluted earnings per share for those reporting periods.

(3) These totals do not include performance based RSUs representing the right to acquire 200,000 and 400,000

shares of common stock at December 31, 2012 and 2011, respectively, for which all targets required to

trigger vesting had not been achieved; therefore, such awards were excluded from the calculation of

weighted average shares used to compute diluted earnings per share for those reporting periods.

The earnings per share amounts are the same for common stock and Class B common stock because the

holders of each class are legally entitled to equal per share distributions whether through dividends or in

liquidation.

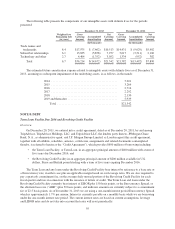

Recently Adopted Accounting Pronouncements

Reporting of Amounts Reclassified Out of Accumulated Other Comprehensive Income

In February 2013, the Financial Accounting Standards Board, or FASB, issued new accounting guidance

which adds new disclosure requirements for items reclassified out of accumulated other comprehensive income.

The new guidance requires that companies present, either in a single note or parenthetically on the face of the

financial statements, the effect of significant amounts reclassified based on its source and is effective for public

companies in interim and annual reporting periods beginning after December 15, 2012. Accordingly, we have

adopted these presentation requirements during the first quarter of 2013. The adoption of this new guidance did

not have a material impact on our consolidated and combined financial statements or related disclosures.

New Accounting Pronouncements Not Yet Adopted

Presentation of an Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a

Tax Credit Carryforward Exists

In July 2013, the FASB issued new accounting guidance on the presentation of unrecognized tax benefits.

The new guidance requires an entity to present an unrecognized tax benefit, or a portion of an unrecognized tax

benefit, as a reduction to a deferred tax asset for a net operating loss carryforward, a similar tax loss, or a tax

credit carryforward, except as follows: to the extent a net operating loss carryforward, a similar tax loss, or a tax

credit carryforward is not available at the reporting date under the tax law of the applicable jurisdiction to settle

any additional income taxes that would result from the disallowance of a tax position or the tax law of the

applicable jurisdiction does not require the entity to use, and the entity does not intend to use the deferred tax

85