TripAdvisor 2013 Annual Report Download - page 180

Download and view the complete annual report

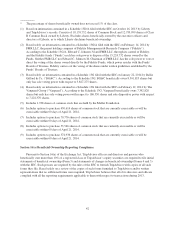

Please find page 180 of the 2013 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.primarily consists of click-based advertising and other advertising services provided to Expedia and its

subsidiaries and is recorded at contract value, which we believe is a reasonable reflection of the value of the

services provided. Revenue represented 23%, 27% and 33% of our total revenue for the years ended

December 31, 2013, 2012 and 2011, respectively. Other operating expenses which were included primarily

within selling and marketing expense were $6.0 million, $6.4 million, and $4.3 million for the years ended

December 31, 2013, 2012 and 2011, respectively, primarily consisted of marketing expense for exit windows.

The receivable balances with Expedia reflected in our consolidated balance sheets as of December 31, 2013 and

December 31, 2012 were $15.8 million and $24.0 million, respectively.

Prior to the Spin-Off, our operating expenses included a shared services fee, which was $9.2 million for the

year ended December 31, 2011, which was comprised of allocations from Expedia for accounting, legal, tax,

corporate development, financial reporting, treasury and real estate functions and included an allocation of

employee compensation within these functions. These allocations were determined on a basis that Expedia and

we considered to be a reasonable reflection of the cost of services provided or the benefit received by us. These

expenses were allocated based on a number of factors including headcount, estimated time spent and operating

expenses. It was not practicable to determine the amounts of these expenses that would have been incurred had

we operated as an unaffiliated entity. In the opinion of our management, the allocation method was reasonable.

We transferred $405.5 million in cash to Expedia in the form of a dividend, prior to completion of the Spin-

Off. Per the Separation Agreement we were to retain $165 million in cash on hand immediately following the

Spin-off and the agreement also provided for a subsequent reconciliation process to ensure the appropriate

amount was retained. The completion of this reconciliation resulted in us recording an additional receivable from

Expedia of $7 million at December 31, 2011, which was subsequently received by us during 2012.

For purposes of governing certain of the ongoing relationships between us and Expedia at and after the

Spin-Off, and to provide for an orderly transition, we and Expedia entered into various agreements, including,

among others, the Separation Agreement, the Tax Sharing Agreement, the Employee Matters Agreement and

Transition Services Agreement, and commercial agreements. The full texts of the Separation Agreement, the Tax

Sharing Agreement, the Employee Matters Agreement and the Transition Services Agreement are incorporated

by reference in our Annual Report on Form 10-K as Exhibits 2.1, 10.2, 10.3 and 10.4. TripAdvisor has satisfied

its obligations under the Separation Agreement, the Employee Matters Agreement and the Transition Services

Agreement. TripAdvisor continues to be subject to certain post-spin obligations under the Tax Sharing

Agreement.

Relationship between Liberty and TripAdvisor

On December 11, 2012, Liberty Interactive Corporation, or Liberty, purchased an aggregate of 4,799,848

shares of common stock of TripAdvisor from Barry Diller, our former Chairman of the Board of Directors and

Senior Executive, and certain of his affiliates (the “Stock Purchase”). As of the record date, Liberty beneficially

owned 18,159,752 shares of our common stock and 12,799,999 shares of our Class B common stock, which

shares constitute 14.0% of the outstanding shares of common stock and 100% of the outstanding shares of Class

B common stock. Assuming the conversion of all of the Liberty’s shares of Class B common stock into common

stock, Liberty would beneficially own 21.7% of the outstanding common stock (calculated in accordance with

Rule 13d-3). Because each share of Class B common stock generally is entitled to ten votes per share and each

share of common stock is entitled to one vote per share, Liberty may be deemed to beneficially own equity

securities representing approximately 56.7% of our voting power. As a result, Liberty is effectively able to

control the outcome of all matters submitted to a vote or for the consent of TripAdvisor’s stockholders (other

than with respect to the election by the holders of TripAdvisor common stock of 25% of the members of

TripAdvisor’s Board of Directors and matters as to which Delaware law requires a separate class vote).

44