Saks Fifth Avenue 2011 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2011 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Website Access to Information

The Company provides access, free of charge, to the Company’s annual report on Form 10-K, quarterly reports

on Form 10-Q, current reports on Form 8-K and all amendments to those reports as soon as reasonably

practicable after the reports are electronically filed with or furnished to the Securities and Exchange

Commission (“SEC”) through the Company’s website, www.saksincorporated.com.

Certifications

The Company filed the certification of its Chief Executive Officer with the New York Stock Exchange (“NYSE”) in

fiscal 2011 as required pursuant to Section 303A.12(a) of the NYSE Listed Company Manual, and the Company

has filed the Sarbanes-Oxley Act Section 302 and Section 906 certifications of its principal executive officer and

principal financial officer with the SEC, which are attached hereto as Exhibits 31.1, 31.2, and 32.1.

Item 1A. Risk Factors.

The following are risk factors that affect the Company’s business, financial condition, results of operations, and

cash flows, some of which are beyond the Company’s control. These risk factors should be considered in

connection with evaluating the forward-looking statements contained in this Annual Report on Form 10-K. If

any of the events described below were to actually occur, the Company’s business, financial condition, results

of operations or cash flows could be adversely affected and results could differ materially from expected and

historical results.

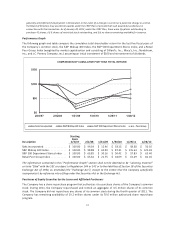

A decline in the demand for luxury goods due to difficult macroeconomic conditions has had and could

continue to have an adverse impact on the Company’s results of operations.

The Company is focused on the luxury retail sector. SFA stores, Saks Direct and OFF 5TH stores offer a wide

assortment of luxury fashion apparel, shoes, accessories, jewelry, cosmetics, and gift items. All of the goods that

the Company sells are discretionary items. Changes in consumer confidence and fluctuations in financial

markets can influence cyclical trends, particularly in the luxury sector. Consequently, starting in the fall of 2008,

the downturn in the economy resulted in fewer customers shopping in the Company’s stores. In response, and

in order to reduce inventory levels, the Company was required to take additional markdowns and to increase

promotional events, which negatively impacted the Company’s profitability in 2008 and 2009. In addition, as a

result of the decrease in consumer spending, the Company was forced to reduce costs. Although the luxury

sector experienced a recovery in 2010 and 2011, there can be no assurance that the economy will continue to

improve or that the Company will be successful in sustaining profitability. In addition, in the event that the

Company is unsuccessful in sustaining profitability, the Company may not be able to realize its net deferred tax

assets, which would require the Company to record a valuation allowance that could have a material impact on

its results of operations in the period in which it is recorded.

Poor economic conditions have affected and may continue to affect consumer spending which has harmed

and may continue to harm the Company’s business.

The retail industry is continuously subject to domestic and international economic trends. The success of the

Company’s business depends to a significant extent upon the level of consumer spending. A number of factors

affect the level of consumer spending on merchandise that the Company offers, including, among other things:

▪general economic, industry, and weather conditions;

▪the performance of the financial, equity, and credit markets;

▪current and expected unemployment levels;

▪crude oil prices that affect gasoline and heating oil prices;

▪the level of consumer debt;

▪the level of consumer savings;

▪interest rates;

7