Saks Fifth Avenue 2011 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2011 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2.0% Convertible Senior Notes

As of January 28, 2012, the Company had $230.0 million of convertible senior notes outstanding that bear

interest at a rate of 2.0% per annum and mature in 2024. The provisions of the convertible notes allow the

holder to convert the notes to shares of the Company’s common stock at a conversion rate of 83.5609 shares

per one thousand dollars in principal amount of notes (subject to an anti-dilution adjustment). The holder may

put the debt back to the Company in 2014 or 2019 and the convertible notes became callable at the option of

the Company beginning on March 21, 2011. The Company can settle a conversion of the notes with shares,

cash, or a combination thereof at its discretion. The holders may convert the notes at the following times,

among others: (i) if the Company’s share price is greater than 120% of the applicable conversion price for a

certain trading period; (ii) if the credit ratings of the convertible notes are below a certain threshold; or

(iii) upon the occurrence of certain consolidations, mergers or share exchange transactions involving the

Company. As of January 28, 2012, none of the criteria were met.

The Company used approximately $25.0 million of the proceeds from the issuances to enter into a convertible

note hedge and written call options on its common stock to reduce the exposure to dilution from the

conversion of the notes. As of January 28, 2012, both the convertible note hedge and written call options had

expired.

The Company estimated the fair value of the liability component, as of the date of issuance, of its 2.0%

convertible senior notes assuming a 6.25% non-convertible borrowing rate to be $158.1 million. The difference

between the fair value and the principal amount of the notes was $71.9 million. This amount was recorded as a

debt discount and as an increase to additional paid-in capital as of the issuance date. The discount is being

amortized over the expected life of a similar liability that does not have an associated equity component

(considering the effects of embedded features other than the conversion option). Since the holders of the

convertible notes have put options in 2014 and 2019, the debt instrument is being accreted to par value using

the effective interest method from issuance until the first put date in 2014, resulting in an increase in non-cash

interest expense. The current unamortized discount of $19.2 million will be recognized over the remaining 2.1

year period.

The Company believes it will have sufficient cash on hand, availability under its revolving credit facility, and

access to various capital markets to repay both the convertible notes at maturity.

Capital Leases

As of January 28, 2012, the Company had $52.9 million in capital leases covering various properties and pieces

of equipment. The terms of the capital leases provide the lessor with a security interest in the asset being

leased and require the Company to make periodic lease payments, aggregating between $6.0 million and $8.0

million per year, excluding interest payments.

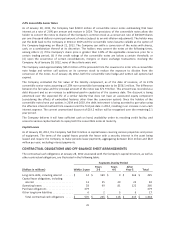

CONTRACTUAL OBLIGATIONS AND OFF-BALANCE SHEET ARRANGEMENTS

The contractual cash obligations at January 28, 2012 associated with the Company’s capital structure, as well as

other contractual obligations, are illustrated in the following table:

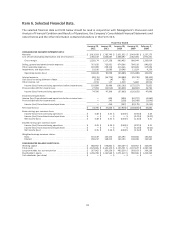

Payments Due by Period

(Dollars in millions) Within 1 year

Years

2-3

Years

4-5

After

Year 5 Total

Long-term debt, including interest ....... $ 14 $ 139 $ 9 $ 263 $ 425

Capital lease obligations, including

interest .......................... 13 25 20 24 82

Operating leases ..................... 58 99 81 122 360

Purchase obligations .................. 479 - - - 479

Other long-term liabilities .............. 623617

Total contractual cash obligations ..... $ 570 $ 265 $ 113 $ 415 $ 1,363

28