Saks Fifth Avenue 2011 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2011 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

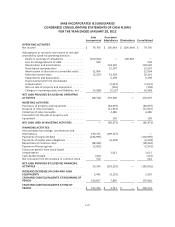

SAKS INCORPORATED & SUBSIDIARIES

CONDENSED CONSOLIDATING STATEMENTS OF CASH FLOWS

FOR THE YEAR ENDED JANUARY 30, 2010

Saks

Incorporated

Guarantor

Subsidiaries Eliminations Consolidated

OPERATING ACTIVITIES

Net loss ..................................... $ (57,919) $ (32,819) $ 32,819 $ (57,919)

Loss from discontinued operations ................ (257) (257) 257 (257)

Loss from continuing operations .................. (57,662) (32,562) 32,562 (57,662)

Adjustments to reconcile net loss to net cash provided

by (used in) operating activities:

Equity in earnings of subsidiaries ............... 32,562 (32,562) —

Depreciation and amortization ................. 135,162 135,162

Impairments and dispositions .................. 29,348 29,348

Loss on extinguishment of debt ................ (783) (783)

Equity compensation ......................... 16,846 16,846

Amortization of discount on convertible notes .... 9,819 9,819

Deferred income taxes ....................... 1,886 (42,471) (40,585)

Gain on sale of property and equipment ......... (628) (628)

Changes in operating assets and liabilities, net .... (9,142) 123,500 114,358

Net cash provided by (used in) operating activities -

continuing operations ........................ (23,320) 229,195 — 205,875

Net cash used in operating activities - discontinued

operations ................................. (13,670) (13,670)

NET CASH PROVIDED BY (USED IN) OPERATING

ACTIVITIES ................................... (23,320) 215,525 — 192,205

INVESTING ACTIVITIES

Purchases of property and equipment ............. — (74,577) — (74,577)

Proceeds from the sale of property and equipment . . 643 643

Net cash used in investing activities - continuing

operations ................................. — (73,934) — (73,934)

Net cash used in investing activities - discontinued

operations ................................. — —

NET CASH USED IN INVESTING ACTIVITIES ......... — (73,934) — (73,934)

FINANCING ACTIVITIES

Intercompany borrowings, contributions and

distributions .................................. 136,001 (136,001) — —

Proceeds from issuance of convertible senior notes . . 120,000 120,000

Proceeds from (payments on) revolving credit

facility ...................................... (156,675) (156,675)

Payments of long-term debt ..................... (22,208) (22,208)

Payments of capital lease obligations .............. (4,673) (4,673)

Payment of debt issuance costs .................. (13,105) (13,105)

Cash dividends paid ............................ (781) (781)

Net proceeds from the issuance of common stock . . . 96,199 96,199

Net cash provided by (used in) financing activities -

continuing operations ........................ 159,431 (140,674) — 18,757

Net cash used in financing activities - discontinued

operations ................................. — —

NET CASH PROVIDED BY (USED IN) FINANCING

ACTIVITIES ................................... 159,431 (140,674) — 18,757

INCREASE IN CASH AND CASH EQUIVALENTS ....... 136,111 917 — 137,028

CASH AND CASH EQUIVALENTS AT BEGINNING OF

PERIOD ..................................... 236 10,037 — 10,273

CASH AND CASH EQUIVALENTS AT END OF

PERIOD ..................................... $ 136,347 $ 10,954 $ — $ 147,301

F-42