Saks Fifth Avenue 2011 Annual Report Download - page 65

Download and view the complete annual report

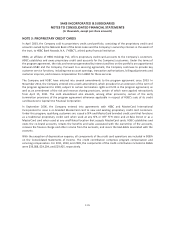

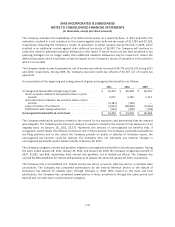

Please find page 65 of the 2011 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts)

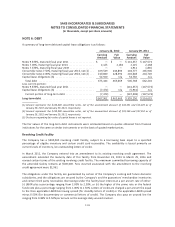

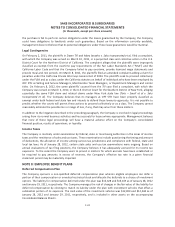

During periods in which availability under the agreement is $62,500 or more, the Company is not subject to

financial covenants. If and when availability under the agreement decreases to less than $62,500, the Company

will be subject to a minimum fixed charge coverage ratio of 1.0 to 1.0. There is no debt rating trigger. As of

January 28, 2012, the Company was not subject to the minimum fixed charge coverage ratio. The credit

agreement contains default provisions that are typical for this type of financing, including a provision that would

trigger a default under the credit agreement if a default were to occur in another debt instrument resulting in

the acceleration of principal of more than $20,000 under that other instrument.

The revolving credit agreement permits additional debt in specific categories including the following (each

category being subject to limitations as described in the revolving credit agreement): (i) debt arising from

permitted sale/leaseback transactions; (ii) debt to finance purchases of machinery, equipment, real estate and

other fixed assets; (iii) debt in connection with permitted acquisitions; and (iv) unsecured debt. The revolving

credit agreement also permits other debt (including permitted sale/leaseback transactions) in an aggregate

amount not to exceed $500,000 at any time, including secured debt, so long as it is a permitted lien as defined

by the revolving credit agreement. The revolving credit agreement also places certain restrictions on, among

other things, asset sales, the ability to make acquisitions and investments, and to pay dividends.

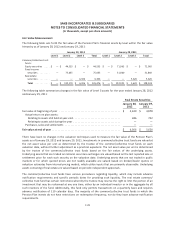

The Company routinely issues stand-by and documentary letters of credit principally related to the funding of

insurance reserves. Outstanding letters of credit reduce availability under the revolving line of credit. During

2011, the average amount of letters of credit issued under the credit agreement was $13,060. The highest

amount of letters of credit outstanding under the agreement during 2011 was $20,159. As of January 28, 2012,

the Company had no direct outstanding borrowings and had letters of credit outstanding of $6,443. Based on

the letters of credit outstanding and the balance of eligible inventory and credit card receivables, the Company

had $471,522 of availability under the facility as of January 28, 2012.

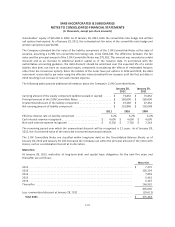

Senior Notes

As of January 28, 2012, the Company had $2,125 of unsecured senior notes outstanding that mature in 2013

with an interest rate of 7.0%. The senior notes are guaranteed by all of the subsidiaries that guarantee the

Company’s revolving credit facility. The notes permit certain sale/leaseback transactions but place certain

restrictions around the use of proceeds generated from a sale/leaseback transaction. The terms of the senior

notes require all principal to be repaid at maturity. There are no financial covenants associated with these

notes, and there are no debt-rating triggers.

During April 2011, the Company redeemed $1,911 of its 7.375% senior notes that were set to mature in 2019.

The redemption of these notes resulted in a loss on extinguishment of $539.

During May 2010, the Company repurchased $797 of its 7.0% senior notes that were set to mature in 2013. The

repurchase of these notes resulted in a loss on extinguishment of $4.

In June and July 2009, the Company repurchased $23,013 of its 7.5% senior notes that matured in December

2010. The repurchase of these notes resulted in a gain on extinguishment of $783.

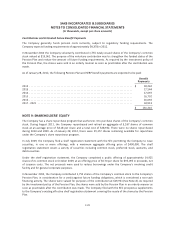

Convertible Notes

7.5% Convertible Notes

The Company issued $120,000 of 7.5% convertible notes in May 2009 (the “7.5% Convertible Notes”). The 7.5%

Convertible Notes mature in December 2013 and are convertible, at the option of the holders at any time, into

shares of the Company’s common stock at a conversion rate of $5.54 per share of common stock (21,670 shares

of common stock to be issued upon conversion). The Company can settle a conversion of the notes with shares,

cash, or a combination thereof at its discretion.

F-20