Saks Fifth Avenue 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts)

shareholders’ equity of $25,000 in 2004. As of January 28, 2012, both the convertible note hedge and written

call options had expired. As of January 29, 2011, the estimated net fair value of the convertible note hedge and

written call options was $4,901.

The Company estimated the fair value of the liability component of the 2.0% Convertible Notes at the date of

issuance, assuming a 6.25% non-convertible borrowing rate, to be $158,148. The difference between the fair

value and the principal amount of the 2.0% Convertible Notes was $71,852. This amount was recorded as a debt

discount and as an increase to additional paid-in capital as of the issuance date. In accordance with the

authoritative accounting guidance, the debt discount should be amortized over the expected life of a similar

liability that does not have an associated equity component (considering the effects of embedded features

other than the conversion option). Since the holders of the notes have put options in 2014 and 2019, the debt

instrument is accreted to par value using the effective interest method from issuance until the first put date in

2014 resulting in an increase in non-cash interest expense.

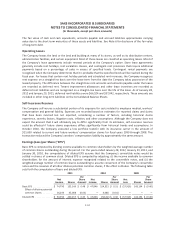

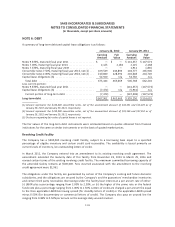

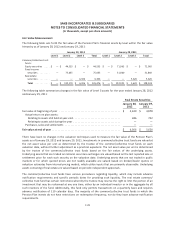

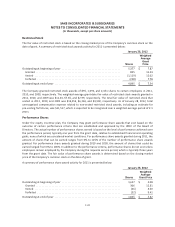

The following tables provide additional information about the Company’s 2.0% Convertible Notes.

January 28,

2012

January 29,

2011

Carrying amount of the equity component (additional paid-in capital) ..... $ 71,852 $ 71,852

Principal amount of the 2.0% Convertible Notes ....................... $ 230,000 $ 230,000

Unamortized discount of the liability component ...................... $ 19,160 $ 27,352

Net carrying amount of liability component .......................... $ 210,840 $ 202,648

2011 2010 2009

Effective interest rate on liability component ................. 6.2% 6.2% 6.2%

Cash interest expense recognized .......................... $ 4,600 $ 4,600 $ 4,600

Non-cash interest expense recognized ...................... $ 8,192 $ 7,702 $ 7,243

The remaining period over which the unamortized discount will be recognized is 2.1 years. As of January 28,

2012, the if-converted value of the notes did not exceed its principal amount.

The 2.0% Convertible Notes are classified within long-term debt on the Consolidated Balance Sheets as of

January 28, 2012 and January 29, 2011 because the Company can settle the principal amount of the notes with

shares, cash or a combination thereof at its discretion.

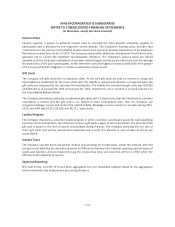

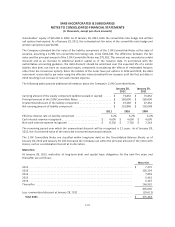

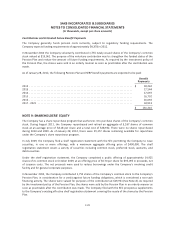

Maturities

At January 28, 2012, maturities of long-term debt and capital lease obligations for the next five years and

thereafter are as follows:

Maturities

2012 ........................................................................ $ 7,472

2013 ........................................................................ 130,154

2014 ........................................................................ 7,859

2015 ........................................................................ 6,461

2016 ........................................................................ 6,167

Thereafter ................................................................... 246,932

405,045

Less: unamortized discount at January 28, 2012 ...................................... (29,611)

Total debt .................................................................. $ 375,434

F-22