Saks Fifth Avenue 2011 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2011 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts)

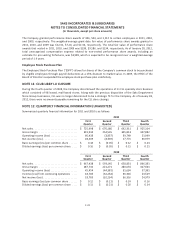

NOTE 10: STOCK-BASED COMPENSATION

The Company maintains an equity incentive plan, which allows for the granting of stock options, stock

appreciation rights, restricted stock, performance share awards and other forms of equity awards to

employees, directors, and officers. As of January 28, 2012, there were 2,675 shares available for future grants

under the equity incentive plan. Stock options granted generally vest over a four-year period from the grant

date and have a contractual term of seven to ten years from the grant date. Restricted stock and performance

share awards generally vest over periods ranging from three to five years from the grant date, although the

equity incentive plan permits accelerated vesting in certain circumstances at the discretion of the HRCC of the

Board of Directors. The Company does not use cash to settle any of its stock-based awards and issues new

shares of common stock upon the exercise of stock options and the granting of restricted stock and

performance shares.

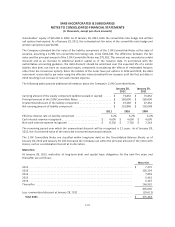

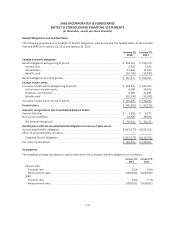

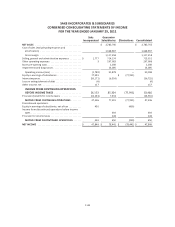

Total stock-based compensation expense and related tax benefits recognized in fiscal years 2011, 2010, and

2009 are as follows:

2011 2010 2009

Stock options ............................................. $ 1,293 $ 2,016 $ 2,197

Restricted stock ........................................... 10,922 11,510 10,974

Performance share awards .................................. 3,382 3,240 3,675

Total stock-based compensation ........................... $ 15,597 $ 16,766 $ 16,846

Total income tax benefit recognized related to stock-based

compensation expense ................................... $ 6,089 $ 6,871 $ 6,570

Stock Options

The fair value of stock options is determined on the grant date utilizing the Black-Scholes valuation model. The

Black-Scholes model estimates the expected value employees will receive from the stock options based on a

number of assumptions, such as interest rates, employee exercises, the Company’s stock price and dividend

yield. The weighted-average Black-Scholes fair value assumptions utilized in determining grant-date fair values

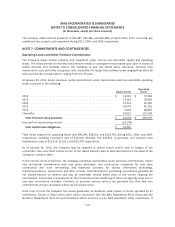

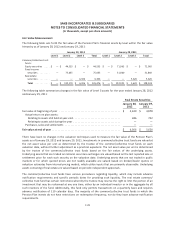

are as follows:

2011 2010 2009

Expected term ........................................................ n/a n/a 4.75 years

Risk-free interest rate .................................................. n/a n/a 2.1%

Expected volatility .................................................... n/a n/a 57.0%

Expected dividend yield ................................................ n/a n/a 0.0%

The expected term is the period over which employee groups are expected to hold the stock options until they

are exercised and it determines the period for which the risk-free interest rate, volatility, and dividend yield

must be applied. The expected term is calculated using the simplified method. The risk-free interest rate is

based on the U.S. Treasury rate securities that mature over the expected term of the stock option. Volatility

reflects movements in the Company’s stock price over the most recent historical period equivalent to the

expected term. The dividend yield is zero as the Company does not anticipate declaring dividends in the near

term.

F-30