Saks Fifth Avenue 2011 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2011 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts)

The fair value of cash and cash equivalents, accounts payable and accrued liabilities approximates carrying

value due to the short-term maturities of these assets and liabilities. See Note 6 for disclosure of the fair value

of long-term debt.

Operating Leases

The Company leases the land or the land and building at many of its stores, as well as its distribution centers,

administrative facilities, and certain equipment. Most of these leases are classified as operating leases. Most of

the Company’s lease agreements include renewal periods at the Company’s option. Store lease agreements

generally include rent holidays, rent escalation clauses, and contingent rent provisions that require additional

payments based on a percentage of sales in excess of specified levels. Contingent rental payments are

recognized when the Company determines that it is probable that the specified levels will be reached during the

fiscal year. For leases that contain rent holiday periods and scheduled rent increases, the Company recognizes

rent expense on a straight-line basis over the lease term from the date the Company takes possession of the

leased property. The difference between the straight-line rent amounts and amounts payable under the leases

are recorded as deferred rent. Tenant improvement allowances and other lease incentives are recorded as

deferred rent liabilities and are recognized on a straight–line basis over the life of the lease. As of January 28,

2012 and January 29, 2011, deferred rent liabilities were $66,524 and $57,042, respectively. These amounts are

included in other long-term liabilities on the Consolidated Balance Sheets.

Self-Insurance Reserves

The Company self-insures a substantial portion of its exposure for costs related to employee medical, workers’

compensation and general liability. Expenses are recorded based on estimates for reported claims and claims

that have been incurred but not reported, considering a number of factors, including historical claims

experience, severity factors, litigation costs, inflation, and other assumptions. Although the Company does not

expect the amount that it will ultimately pay to differ significantly from its estimates, self-insurance reserves

could be affected if future claims experience differs significantly from historical trends and assumptions. In

October 2010, the Company executed a loss portfolio transfer with its insurance carrier in the amount of

$11,450 related to current and future workers’ compensation claims for fiscal years 1999 through 2008. This

transaction reduced the Company’s workers’ compensation liability by approximately the same amount.

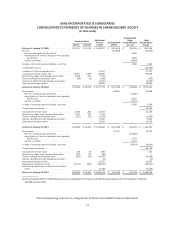

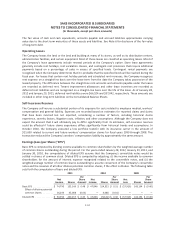

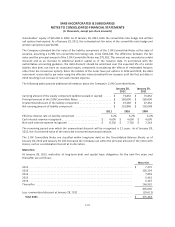

Earnings (Loss) per Share (“EPS”)

Basic EPS is computed by dividing income available to common shareholders by the weighted-average number

of common shares outstanding during the period. For the years ended January 28, 2012, January 29, 2011, and

January 30, 2010, the computations of diluted EPS assume that the Company’s convertible notes would be

settled in shares of common stock. Diluted EPS is computed by adjusting: (i) the income available to common

shareholders for the amount of interest expense recognized related to the convertible notes, and (ii) the

weighted-average number of common shares outstanding to assume conversion of the Company’s convertible

notes and the issuance of all other dilutive potential common shares, if the effect is dilutive. The following table

sets forth the computation of basic and diluted EPS:

2011 2010 2009

Net

Income Shares

Per

Share

Amount

Net

Income Shares

Per

Share

Amount

Net

Loss Shares

Per

Share

Amount

Basic EPS ................$ 74,790 155,149 $ 0.48 $ 47,846 154,325 $ 0.31 $ (57,919) 143,194 $ (0.40)

Effect of dilutive potential

common shares ........ 16,204 45,088 (0.03) — 4,088 (0.01) — — —

Diluted EPS ..............$ 90,994 200,237 $ 0.45 $ 47,846 158,413 $ 0.30 $ (57,919) 143,194 $ (0.40)

F-12