Saks Fifth Avenue 2011 Annual Report Download - page 24

Download and view the complete annual report

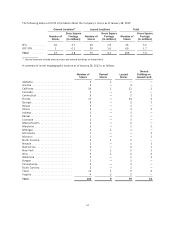

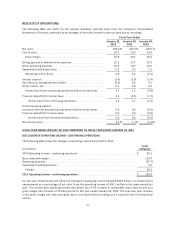

Please find page 24 of the 2011 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NET SALES

For the year ended January 28, 2012, total net sales increased 8.2% to $3,013.6 million from $2,785.7 million for

the year ended January 29, 2011. Consolidated comparable store sales increased $252.8 million, or 9.5%, from

$2,658.2 million for the year ended January 29, 2011 to $2,911.0 million for the year ended January 28, 2012.

Comparable store sales are calculated on a rolling 13-month basis. Thus, to be included in the comparison, a

store must be open for 13 months. The additional month is used to transition the first month impact of a new

store opening. Correspondingly, closed stores are removed from the comparable store sales comparison when

they begin liquidating merchandise. Expanded or remodeled stores are included in the comparable store sales

comparison, except for the periods in which they are closed for remodeling and renovation.

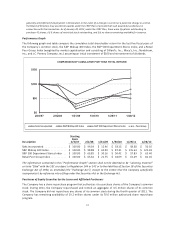

GROSS MARGIN

For the year ended January 28, 2012, gross margin was $1,228.2 million, or 40.8% of net sales, compared to

$1,117.3 million, or 40.1% of net sales, for the year ended January 29, 2011. The increase in gross margin dollars

and gross margin rate was primarily the result of higher sales, increased full-price selling and a reduced level of

promotional activity.

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES (“SG&A”)

For the year ended January 28, 2012, SG&A was $767.6 million, or 25.5% of net sales, compared to $716.0

million, or 25.7% of net sales, for the year ended January 29, 2011. The increase of $51.6 million in expenses

was primarily driven by higher variable costs associated with the $227.9 million sales increase for the year as

well as incremental expenses incurred to support the growth in Saks Direct. Additionally, the Company

experienced an increase in proprietary credit card income related to the previously announced contract

changes with HSBC.

OTHER OPERATING EXPENSES

For the year ended January 28, 2012, other operating expenses were $302.1 million, or 10.0% of net sales,

compared to $298.1 million, or 10.7% of net sales, for the year ended January 29, 2011. The increase of $4.0

million was principally driven by an increase in taxes other than income taxes of $2.9 million, an increase in

property and equipment rentals of $0.7 million and an increase in store pre-opening costs of $0.6 million. These

increases were partially offset by a decrease in depreciation and amortization of $0.2 million.

IMPAIRMENTS AND DISPOSITIONS

For the year ended January 28, 2012, impairments and dispositions included net charges of $10.1 million

compared to net charges of $13.1 million for the year ended January 29, 2011. During 2011, the Company

incurred $4.9 million of store-closing related costs, primarily driven by a lease termination charge incurred in

connection with the relocation of the Hilton Head OFF 5TH store. Also included in impairments and dispositions

for 2011 were $5.0 million of asset impairments and $0.2 million of asset dispositions in the normal course of

business. The prior year charges of $13.1 million included store-closing costs of $12.1 million associated with

the closing of seven SFA stores and one OFF 5TH store and $1.0 million of asset impairments and dispositions in

the normal course of business.

INTEREST EXPENSE

Interest expense decreased to $48.1 million in 2011 from $56.7 million in 2010 and, as a percentage of net

sales, was 1.6% in 2011 and 2.0% in 2010. The decrease of $8.6 million was primarily due to the extinguishment

of $22.9 million of the 7.5% senior notes that matured in December 2010 and extinguishment of $141.6 million

of the 9.875% senior notes that matured in October 2011. Non-cash interest expense associated with the

amortization of the debt discount on the Company’s convertible notes was $13.0 million and $11.9 million for

the years ended January 28, 2012 and January 29, 2011, respectively.

22