Saks Fifth Avenue 2011 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2011 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

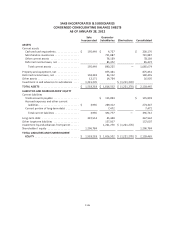

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts)

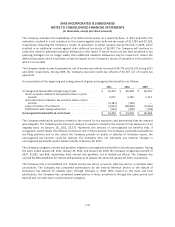

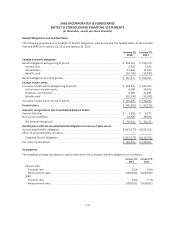

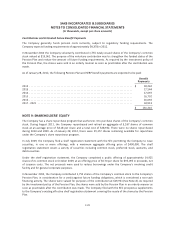

Benefit Obligations and Funded Status

The following provides a reconciliation of benefit obligations, plan assets and the funded status of the Pension

Plan and SERP as of January 28, 2012 and January 29, 2011:

January 28,

2012

January 29,

2011

Change in benefit obligation:

Benefit obligation at beginning of period ................................... $ 158,761 $ 153,570

Interest cost ........................................................ 6,520 7,315

Actuarial loss ....................................................... 12,846 11,259

Benefits paid ....................................................... (10,750) (13,383)

Benefit obligation at end of period ........................................ $ 167,377 $ 158,761

Change in plan assets:

Fair value of plan assets at beginning of period .............................. $ 128,545 $ 103,755

Actual return on plan assets ........................................... 4,298 16,340

Employer contributions ............................................... 4,383 21,833

Benefits paid ....................................................... (10,750) (13,383)

Fair value of plan assets at end of period ................................... $ 126,476 $ 128,545

Funded status ........................................................ $ (40,901) $ (30,216)

Amounts recognized on the Consolidated Balance Sheets:

Current liabilities ...................................................... $ 1,281 $ 1,272

Non-current liabilities .................................................. 39,620 28,944

Net amount recognized ............................................... $ 40,901 $ 30,216

Benefit plans with accumulated benefit obligations in excess of plan assets:

Accumulated benefit obligation .......................................... $(167,377) $ (158,761)

Effect of projected salary increases ....................................... — —

Projected benefit obligation ........................................... $(167,377) $ (158,761)

Fair value of plan assets ................................................ $ 126,476 $ 128,545

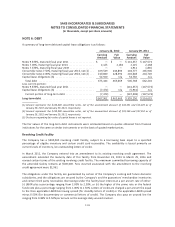

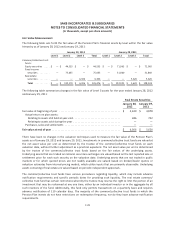

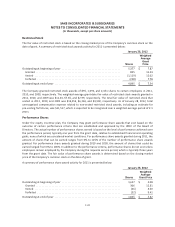

Assumptions

The weighted-average assumptions used to determine the Company’s benefit obligation are as follows:

January 28,

2012

January 29,

2011

Pension Plan:

Discount rate ....................................................... 3.6% 4.8%

Measurement date .................................................. 1/28/2012 1/29/2011

SERP:

Discount rate ....................................................... 3.8% 5.1%

Measurement date .................................................. 1/28/2012 1/29/2011

F-26