Saks Fifth Avenue 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts)

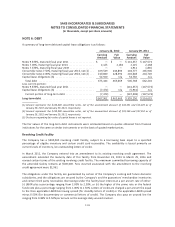

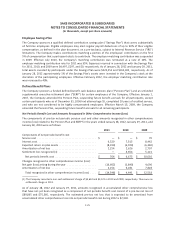

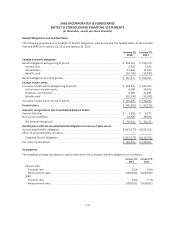

Contributions and Estimated Future Benefit Payments

The Company generally funds pension costs currently, subject to regulatory funding requirements. The

Company expects funding requirements of approximately $4,378 in 2012.

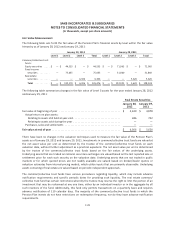

In November 2010 the Company voluntarily contributed 1,755 newly issued shares of the Company’s common

stock valued at $19,961. The purpose of the voluntary contribution was to strengthen the funded status of the

Pension Plan and reduce the amount of future funding requirements. As required by the investment policy of

the Pension Plan, the shares were sold in an orderly manner as soon as practicable after the contribution was

made.

As of January 28, 2012, the following Pension Plan and SERP benefit payments are expected to be paid:

Benefit

Payments

2012 ........................................................................ $ 18,262

2013 ........................................................................ 17,544

2014 ........................................................................ 17,697

2015 ........................................................................ 16,702

2016 ........................................................................ 16,092

2017 - 2021 .................................................................. 44,913

$ 131,210

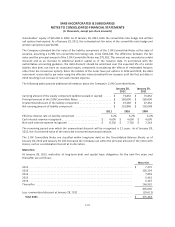

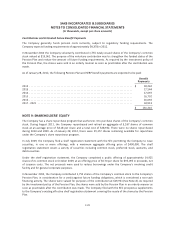

NOTE 9: SHAREHOLDERS’ EQUITY

The Company has a share repurchase program that authorizes it to purchase shares of the Company’s common

stock. During August 2011, the Company repurchased and retired an aggregate of 3,537 shares of common

stock at an average price of $8.18 per share and a total cost of $28,932. There were no shares repurchased

during 2010 and 2009. As of January 28, 2012, there were 29,172 shares remaining available for repurchase

under the Company’s share repurchase program.

In July 2009, the Company filed a shelf registration statement with the SEC permitting the Company to issue

securities, in one or more offerings, with a maximum aggregate offering price of $400,000. The shelf

registration statement covers a variety of securities including common stock, preferred stock, warrants, and

debt securities.

Under the shelf registration statement, the Company completed a public offering of approximately 14,925

shares of its common stock in October 2009, at an offering price of $6.70 per share for $95,095 in proceeds, net

of issuance costs. The net proceeds were used to reduce borrowings under the Company’s revolving credit

facility and for general corporate purposes.

In November 2010, the Company contributed 1,755 shares of the Company’s common stock to the Company’s

Pension Plan, in consideration for a credit against future funding obligations, which is considered a non-cash

financing activity. The shares were valued for purposes of the contribution at $19,961 (See Note 8). As required

by the investment policy of the Pension Plan, the shares were sold by the Pension Plan in an orderly manner as

soon as practicable after the contribution was made. The Company filed with the SEC prospectus supplements

to the Company’s existing effective shelf registration statement covering the resale of the shares by the Pension

Plan.

F-29